Join Fox News for access to this content

Plus special access to select articles and other premium content with your account - free of charge.

By entering your email and pushing continue, you are agreeing to Fox News' Terms of Use and Privacy Policy, which includes our Notice of Financial Incentive.

Please enter a valid email address.

NEWYou can now listen to Fox News articles!

Now that House Republicans have agreed on a budget resolution to finance their legislative priorities, debate begins on the specific tax cuts to include in the final "big, beautiful bill."

At the top of this list is fulfilling President Donald Trump's oft-repeated call to reduce the corporate tax to 15%. This tax rate cut would make the U.S. significantly more competitive and jumpstart our economy still feeling the effects of four years of anti-growth policies.

According to an analysis by the Tax Foundation, a 15% corporate tax rate would significantly boost GDP, wages and jobs.

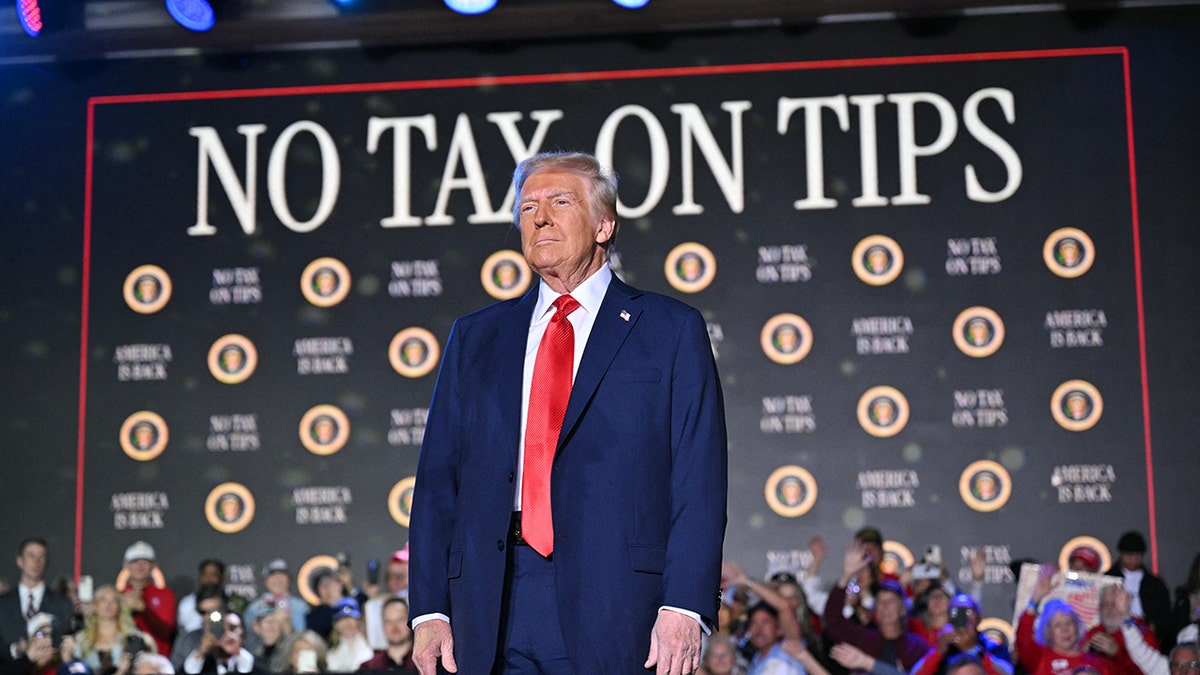

President Donald Trump arrives to speak on his policy to end taxes on tips in Las Vegas on Jan. 25, 2025. (Mandel Ngan/AFP via Getty Images)

The Tax Cuts and Jobs Act, which took effect in 2018, reduced the corporate tax from 35% – one of the world's highest – to 21%, middle of the pack. In response, U.S. corporations increased their domestic investment by an average of 20%, according to an NBER study that analyzed 12,000 corporate tax returns.

TRUMP IS POPULAR AND SO ARE MANY OF HIS POLICIES. DEMOCRATS ARE TANKING

The lower tax rate is a major reason why U.S. living standards have far outpaced other developed countries over the last several years.

A 15% tax rate would create a new wave of success. Shareholders, including the 61% of Americans who own stocks, and ordinary workers would be the biggest beneficiaries.

A 15% corporate tax rate cut would also help small businesses, 1.5 million of which are structured as corporations. Small companies that service corporations and their workers would also benefit from new opportunities and higher revenues.

I HELPED TRUMP GET HIS FIRST TAX CUT BILL THROUGH CONGRESS. FAILURE IS NOT AN OPTION THIS TIME

But what about the vast majority of small businesses structured as pass-throughs and paying tax at individual rates? The Republican tax bill should also give these entities relief similar to that proposed for incorporated businesses.

Small unincorporated businesses were among the biggest beneficiaries of the TCJA. They received a 20% tax deduction, accelerated expensing, and lower tax rates, bringing new life to the nation's entrepreneurship climate.

Nearly 20 million small businesses benefit from the TCJA deduction every year. Unfortunately, the TCJA's small business provisions expire at the end of the year.

CLICK HERE FOR MORE FOX NEWS OPINION

Lawmakers can keep the tax code fair by increasing the 20% small business tax deduction to 25% at the same time they reduce the corporate rate to 15%. This larger deduction means a small business earning $200,000 per year would face an effective tax rate that's roughly the same as corporations (not including other deductions).

Lawmakers should also look to extend this small business deduction to even more pass-through entities. Currently, it phases out at about $200,000 of earnings for non-manufacturer single filers. Significantly increasing this income threshold would allow many more middle-class small businesses to enjoy tax relief, avoid punishments for growth, and compete on a level playing field with corporations.

These corporate and small business tax cuts would spur an economic boom that would pay for much, if not most tax, of their cost in a replay of the original TCJA. Since 2017, inflation-adjusted tax revenue (excluding tariffs) has significantly increased. Democrats and their media allies claiming fiscal calamity from Republican tax cuts were wrong then, and they're wrong now.

CLICK HERE TO GET THE FOX NEWS APP

It is spending, not tax cuts, that is driving the deficit. Since 2017, federal spending has ballooned from $4 trillion annually to nearly $7 trillion due to reckless and inflationary spending. Fortunately, the GOP budget compromise includes a targeted $2 trillion in spending cuts to get the deficit under control.

As lawmakers begin debating which tax cuts to include in their historic reconciliation bill that will determine the country's economic outlook over the next decade, everything should be on the table. But a 15% corporate tax rate and a broad, 25% small business deduction should be the centerpieces.

CLICK HERE TO READ MORE FROM GROVER NORQUIST

CLICK HERE TO READ MORE FROM ALFREDO ORTIZ

Alfredo Ortiz is CEO of Job Creators Network.