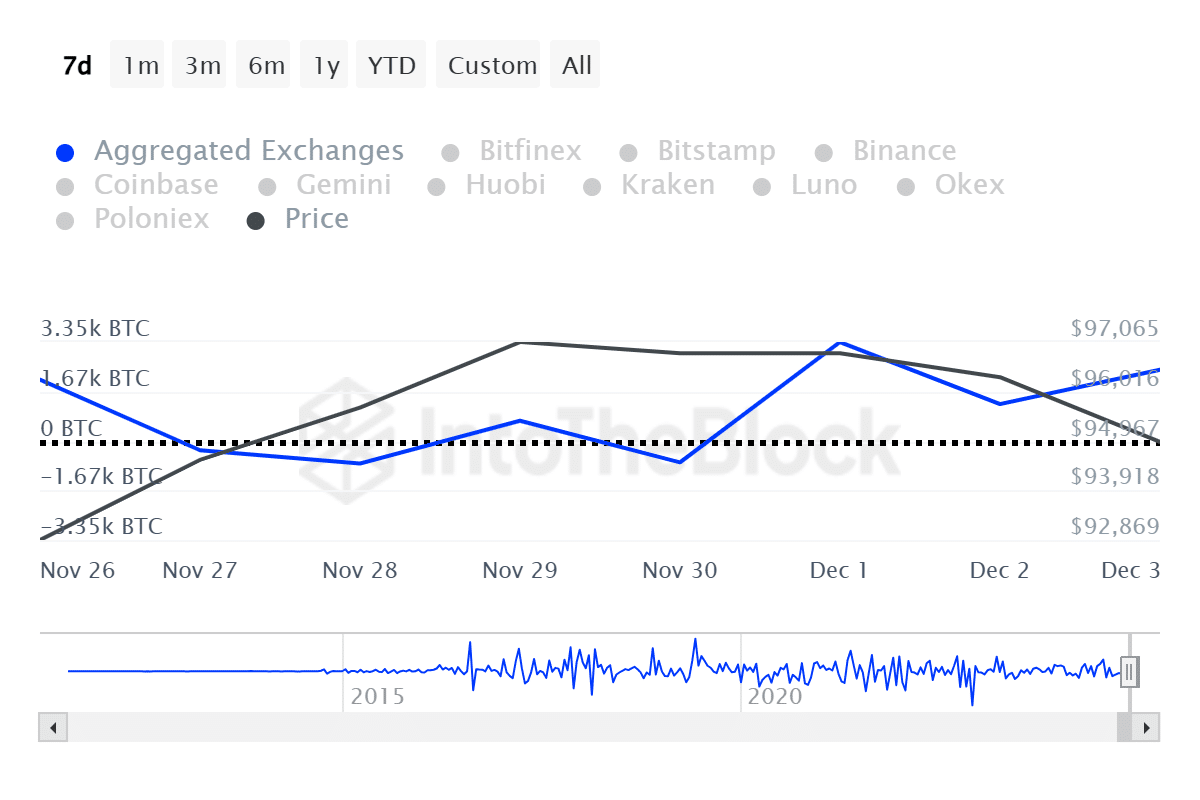

Bitcoin started to see increased inflows into centralized exchanges from Dec. 1, hinting at a potential selloff.

According to data provided by IntoTheBlock, the Bitcoin (BTC) exchange net flows surged from a net outflow of $69 million to a net inflow of $326 million. The flagship cryptocurrency recorded a net inflow of $230 million on Dec. 3.

BTC exchange net flow | Source: IntoTheBlock

BTC exchange net flow | Source: IntoTheBlockIn total, over $562 million in Bitcoin entered CEX platforms, ITB data shows.

Moreover, the asset’s large holder-to-exchange net flow ratio rose to 0.86% on Tuesday, per ITB data. The indicator suggests that Bitcoin whales have been more active than retail holders.

Data from the analytics platform shows that large Bitcoin transactions, worth at least $100,000, also increased from 17,960 to 25,830 in the same timeframe as the exchange net flows.

The large transaction volume surged from $38.7 billion to $87.3 billion in BTC on Monday, Dec. 2. Bitcoin recorded a total of $169.6 billion in whale transactions over the last seven days, according to ITB.

On-chain data shows that an 11-year-old whale address with 2,700 BTC, worth over $257 million, transferred the Bitcoin holding to another wallet for the first time since December 2013, hinting at a potential selloff due to the 157 times return.

The whale accumulated the Bitcoins when the price was hovering around $625 for a total of $1.68 million.

Bitcoin is hovering at $96,500 after gaining 1% over the past 24 hours. Its market cap surpassed the $1.9 trillion market again.

The increased exchange inflows could trigger FUD (fear, uncertainty and doubt) among retail investors. However, a spike in whale accumulation could shift the market sentiment and bring buying pressure.

At this point, the next major bullish catalyst for Bitcoin and altcoins would be the potential U.S. Federal Reserve’s rate cut — the FOMC meeting is scheduled for Dec. 17 and 18.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

By crypto.news | Created at 2024-12-04 08:01:13 | Updated at 2024-12-04 19:04:48

11 hours ago

By crypto.news | Created at 2024-12-04 08:01:13 | Updated at 2024-12-04 19:04:48

11 hours ago