Getty Images

Getty Images

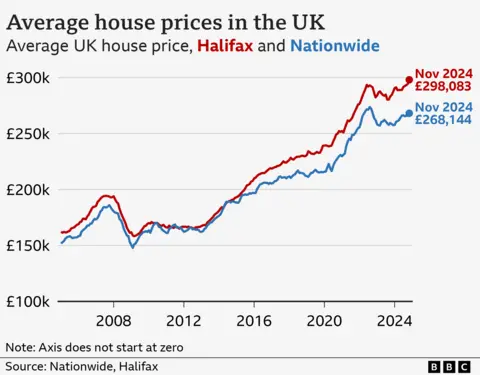

UK house prices rose at their fastest monthly rate of the year in November with further increases expected next year, the Halifax has said.

The UK's largest mortgage lender, part of Lloyds Banking Group, said property values were up 1.3% compared with October - the fifth consecutive monthly rise.

The average house price hit the latest record high of £298,083 last month, surpassing a peak of £293,999 in October.

On an annual basis, house prices have now seen the fastest growth for the past two years.

Halifax said house prices increased by 4.8% in November compared with a year earlier, up from 4% growth in October. That was the strongest annual growth for two years, echoing the view of rival lender, the Nationwide, earlier in the week.

This reflects demand from buyers, but also the relative weakness of the market a year ago.

"Latest figures continue to show improving levels of demand for mortgages, as an easing in mortgage rates boost buyer confidence," said Amanda Bryden, head of mortgages at Halifax.

She said that stronger employment, as well as falling interest rates, would be expected to bring further house price rises for the rest of this year and into next year.

"However, many potential buyers and movers still face significant affordability challenges and buyer confidence may be tested against a changeable economic backdrop," she added.

Jonathan Hopper, chief executive of Garrington Property Finders, said: "Hesitation has turned to hurry in some parts of the market, especially among first-time buyers racing to complete their purchases before the stamp duty thresholds change at the end of March."

Alice Haine, personal finance analyst at Bestinvest by Evelyn Partners, also thinks the rise is linked to stamp duty concerns.

"It means property prices are likely to rise in the run-up to the deadline as buyers and sellers race to beat the tax hike. Beyond the start of April, the market is likely to be more muted as buyers choose to purchase cheaper homes," she said.

Where are prices rising the fastest?

London remains the most expensive place in the UK to buy a house, with the average property there costing £545,439, according to the Halifax.

Northern Ireland continues to record the strongest house price growth in the UK, with an average price of £203,131.

In England, the North West region continued to see the strongest growth, increasing by 5.9% compared to last year. An average property there now costs £237,045.

House prices were up 5.5% on last year in the West Midlands, with an average home costing £257,982.

Halifax said Scotland saw a modest rise in house prices with the average property now costing £208,957, which is 2.8% more than the year before.

Halifax's house price data is based on its own mortgage lending, which does not include buyers who purchase homes with cash, or buy-to-let deals. Cash buyers account for about a third of housing sales.

By BBC (Business) | Created at 2024-12-06 11:04:18 | Updated at 2024-12-22 12:57:10

2 weeks ago

By BBC (Business) | Created at 2024-12-06 11:04:18 | Updated at 2024-12-22 12:57:10

2 weeks ago