Halfway up a 37-storey tower overlooking Hong Kong’s Victoria Harbour, within walking distance from the People’s Liberation Army barracks and the classy Hong Kong Club, sits an unassuming office of a fund manager with an outsize role in the global financial markets.

The spartan office, with two tiny flags of China and Hong Kong providing the only splashes of warmth in a grey, cold ambience, belongs to SAFE Investment Company, the custodian of a third of China’s US$3.227 trillion foreign exchange reserves, according to official records.

Established a month before Hong Kong’s formal return to China’s sovereignty in 1997, the unit was the first of four so-called “golden flowers” – Hua’an, Huaxin, Hua’ou and Huamei – set up by the State Administration of Foreign Exchanges (SAFE) to diversify its reserves and maximise returns. Hua’an, the Chinese name of its Hong Kong unit, signifies the wish for the nation’s security.

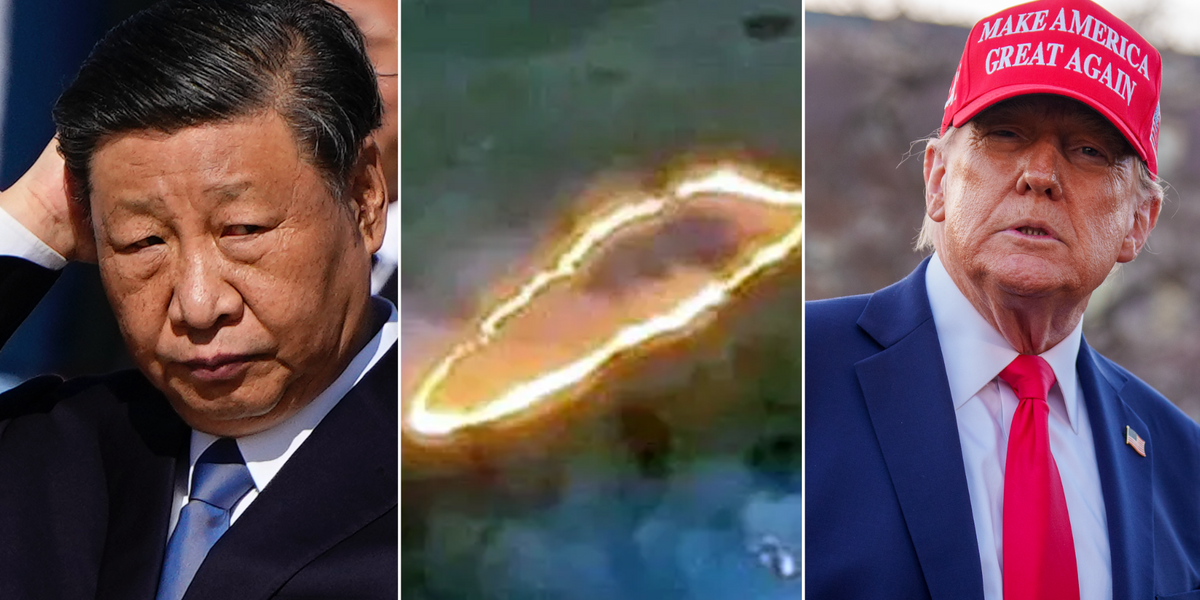

Its existence was alluded to in mid-January, a week before Donald Trump’s formal return to the White House, when Pan Gongsheng, governor of the People’s Bank of China (PBOC), said the central bank would “significantly increase” the allocation of the nation’s reserves to Hong Kong.

That statement provoked more questions than answers, with analysts, academics and lawmakers quizzing officials on the amount, rationale, strategy and timing behind that financial support.

Xia Chun, the chief economist at SSC Research Institute in Hong Kong, estimates that about 16 per cent of China’s foreign exchange reserves are kept in Hong Kong. A “substantial increase”, as hinted by PBOC, could mean almost tripling that allocation over the long run, he said.

By South China Morning Post | Created at 2025-03-15 02:09:57 | Updated at 2025-03-15 09:32:46

7 hours ago

By South China Morning Post | Created at 2025-03-15 02:09:57 | Updated at 2025-03-15 09:32:46

7 hours ago