Mapped: The Top Personal Income Tax Rates in Europe in 2024

Visual Capitalist ^ | 11/16/2024 | Kayla Zhu

Posted on 11/15/2024 7:45:38 AM PST by SeekAndFind

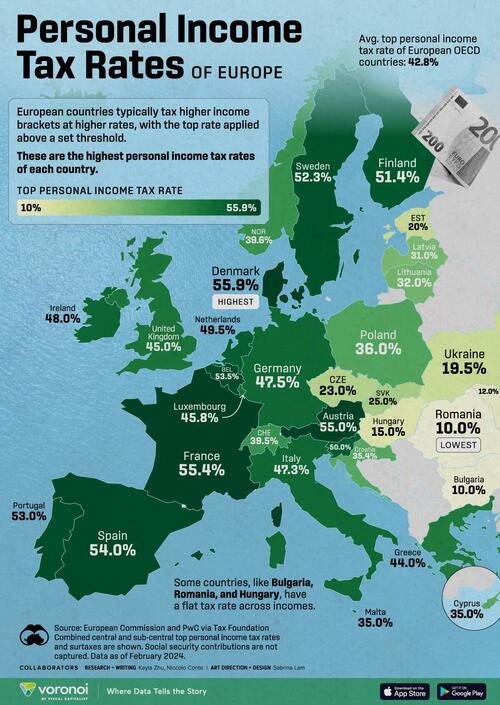

Income tax rates in Europe vary widely and reflect different approaches to funding public services, with countries imposing higher top marginal tax rates often supporting extensive social welfare systems, while those with lower rates may prioritize competitiveness or maintain less comprehensive programs.

This map, via Visual Capitalist's Kayla Zhu, shows the top statutory personal income tax rate of 36 European countries.

European countries typically use a progressive tax system, where higher income brackets are taxed at higher rates, with the top rate applying only to income above a set threshold. These are the highest personal income tax rates of each European country.

The data comes from the European Commission and PwC via Tax Foundation (updated as of February 2024), with combined central and sub-central top personal income tax rates and surtaxes shown. Social security contributions are not included.

Which European Countries Tax Top Earners Most?

Below, we show the top statutory personal income tax rate for 36 major European countries.

| 🇦🇹 Austria | 55.0% |

| 🇧🇪 Belgium | 53.5% |

| 🇧🇬 Bulgaria | 10.0% |

| 🇭🇷 Croatia | 35.4% |

| 🇨🇾 Cyprus | 35.0% |

| 🇨🇿 Czech Republic | 23.0% |

| 🇩🇰 Denmark | 55.9% |

| 🇪🇪 Estonia | 20.0% |

| 🇫🇮 Finland | 51.4% |

| 🇫🇷 France | 55.4% |

| 🇬🇪 Georgia | 20.0% |

| 🇩🇪 Germany | 47.5% |

| 🇬🇷 Greece | 44.0% |

| 🇭🇺 Hungary | 15.0% |

| 🇮🇸 Iceland | 46.3% |

| 🇮🇪 Ireland | 48.0% |

| 🇮🇹 Italy | 47.3% |

| 🇱🇻 Latvia | 31.0% |

| 🇱🇹 Lithuania | 32.0% |

| 🇱🇺 Luxembourg | 45.8% |

| 🇲🇹 Malta | 35.0% |

| 🇲🇩 Moldova | 12.0% |

| 🇳🇱 Netherlands | 49.5% |

| 🇳🇴 Norway | 39.6% |

| 🇵🇱 Poland | 36.0% |

| 🇵🇹 Portugal | 53.0% |

| 🇷🇴 Romania | 10.0% |

| 🇸🇰 Slovakia | 25.0% |

| 🇸🇮 Slovenia | 50.0% |

| 🇪🇸 Spain | 54.0% |

| 🇸🇪 Sweden | 52.3% |

| 🇨🇭 Switzerland | 39.5% |

| 🇹🇷 Turkey | 40.8% |

| 🇺🇦 Ukraine | 19.5% |

| 🇬🇧 United Kingdom | 45.0% |

Among European OECD countries, the average top statutory personal income tax rate is 42.8%.

Denmark (55.9%), France (55.4%), and Austria (55%) have the highest rates, while Hungary (15%), Estonia (20%), and the Czech Republic (23%) have the lowest.

Generally, European countries outside the OECD have lower top tax rates and often use a flat tax system. Bulgaria and Romania have the lowest rate at 10%, followed by Moldova (12%), Ukraine (19.5%), and Georgia (20%).

Scandinavian countries, recognized for their extensive social safety nets and public funding for services like universal healthcare, higher education, and parental leave, also impose relatively high personal income tax rates.

Denmark is making substantial changes to its personal income tax system that will take effect in 2026, which may impact the country’s top earners significantly.

Under the new three-tier tax structure, high-income earners in Denmark making over DKK 2,588,300 may face a total marginal tax rate of up to 60.5%. Denmark ranks sixth in the world for countries with the highest wealth per person in both average and median wealth measurements.

To learn more about taxation across various countries, check out this graphic that visualizes major economies’ tax-to-GDP ratios.

TOPICS: Business/Economy; Society

KEYWORDS: europe; incometax

Dear FRiends, Please use this temporary link to donate by credit card via Authorize.Net:

Or click here to donate by PayPal

Or by mail to: Free Republic, LLC - PO Box 9771 - Fresno, CA 93794

Hopefully, we'll have our normal CC system up and running again soon. Thank you very much for your loyal support!

1 posted on 11/15/2024 7:45:38 AM PST by SeekAndFind

To: SeekAndFind

They tout the high rates because then the country “takes care of you” cradle to grave.

spit!

2 posted on 11/15/2024 7:53:26 AM PST by fwdude (Why is there a "far/radical right," but damned if they'll admit that there is a far/radical left?)

To: SeekAndFind

Tax attorneys and accountants who create tax avoidance schemes must make out like bandits in many of these countries.

3 posted on 11/15/2024 7:54:46 AM PST by cgbg (It is time to pull the Deep State out of the mass media--like ticks from a dog.)

To: SeekAndFind

For reference, the top personal bracket in the US is 51%, including state and local income taxes. Not that far from the EU.

4 posted on 11/15/2024 7:55:04 AM PST by nwrep

To: SeekAndFind

The problem with such analysis is that without looking at property tax, fees, wage taxes outside of income tax, sales tax and capital gains tax you don’t get a true picture. In Texas there is no State income tax but the property tax is crippling if you are retired with a large home.

It takes a very through analysis to see total tax burden.

5 posted on 11/15/2024 8:00:05 AM PST by KC Burke

To: fwdude

"..."takes care of you" cradle to grave"

I'm sure that's lovely.

Who wouldn't want that?

Heh

6 posted on 11/15/2024 8:00:09 AM PST by z3n (Kakistocracy)

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

By Free Republic | Created at 2024-11-15 16:02:53 | Updated at 2024-11-22 21:46:43

1 week ago

By Free Republic | Created at 2024-11-15 16:02:53 | Updated at 2024-11-22 21:46:43

1 week ago