MicroStrategy’s Bitcoin strategy yielded $14 billion in shareholder value in 2024 Oluwapelumi Adejumo · 27 seconds ago

MicroStrategy’s Bitcoin strategy yielded $14 billion in shareholder value in 2024 Oluwapelumi Adejumo · 27 seconds ago

MicroStrategy’s executive chairman, Michael Saylor, said the firm purchased 258,320 BTC at a total cost of $22.07 billion, which equates to an average price of $85,450 per Bitcoin.

The decision yielded remarkable returns for the company, resulting in a BTC annual yield of 74.3%. This enhanced shareholder value by $14.06 billion, translating to approximately $38.5 million daily gains.

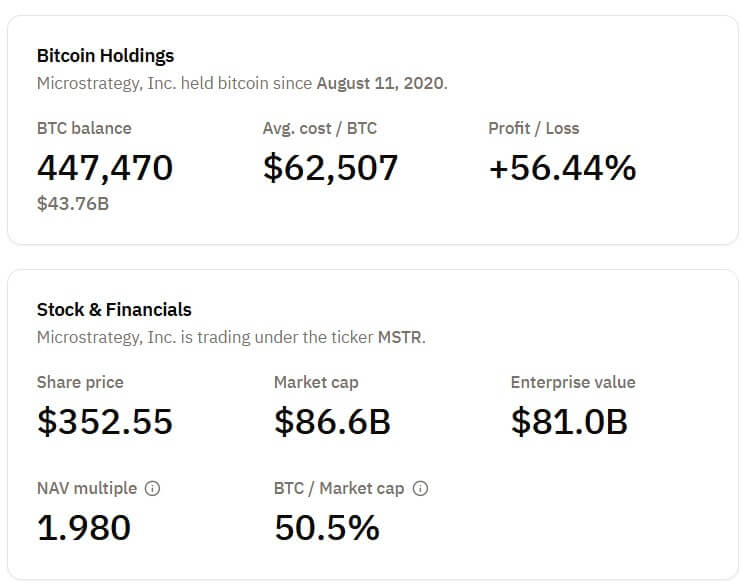

MicroStrategy’s Total Bitcoin Holdings (Source: Bitcoin Treasuries)

MicroStrategy’s Total Bitcoin Holdings (Source: Bitcoin Treasuries)The company’s strategy, which incorporates innovative financing through Bitcoin-backed stock sales, reflects its proactive stance on crypto investments. Meanwhile, this marks the firm’s most significant annual acquisition since it embraced a Bitcoin-focused approach in 2020.

As of Dec. 31, 2024, MicroStrategy owned 447,470 BTC, which solidifies its position as the largest corporate Bitcoin holder. These assets were acquired at a total cost of $27.97 billion but now exceed $43 billion in current market value, according to Bitcoin Treasuries data.

Notably, its Bitcoin holdings valuation equates to more than 50% of the company’s near $87 billion valuation.

By CryptoSlate | Created at 2025-01-07 17:55:44 | Updated at 2025-01-08 16:11:36

22 hours ago

By CryptoSlate | Created at 2025-01-07 17:55:44 | Updated at 2025-01-08 16:11:36

22 hours ago