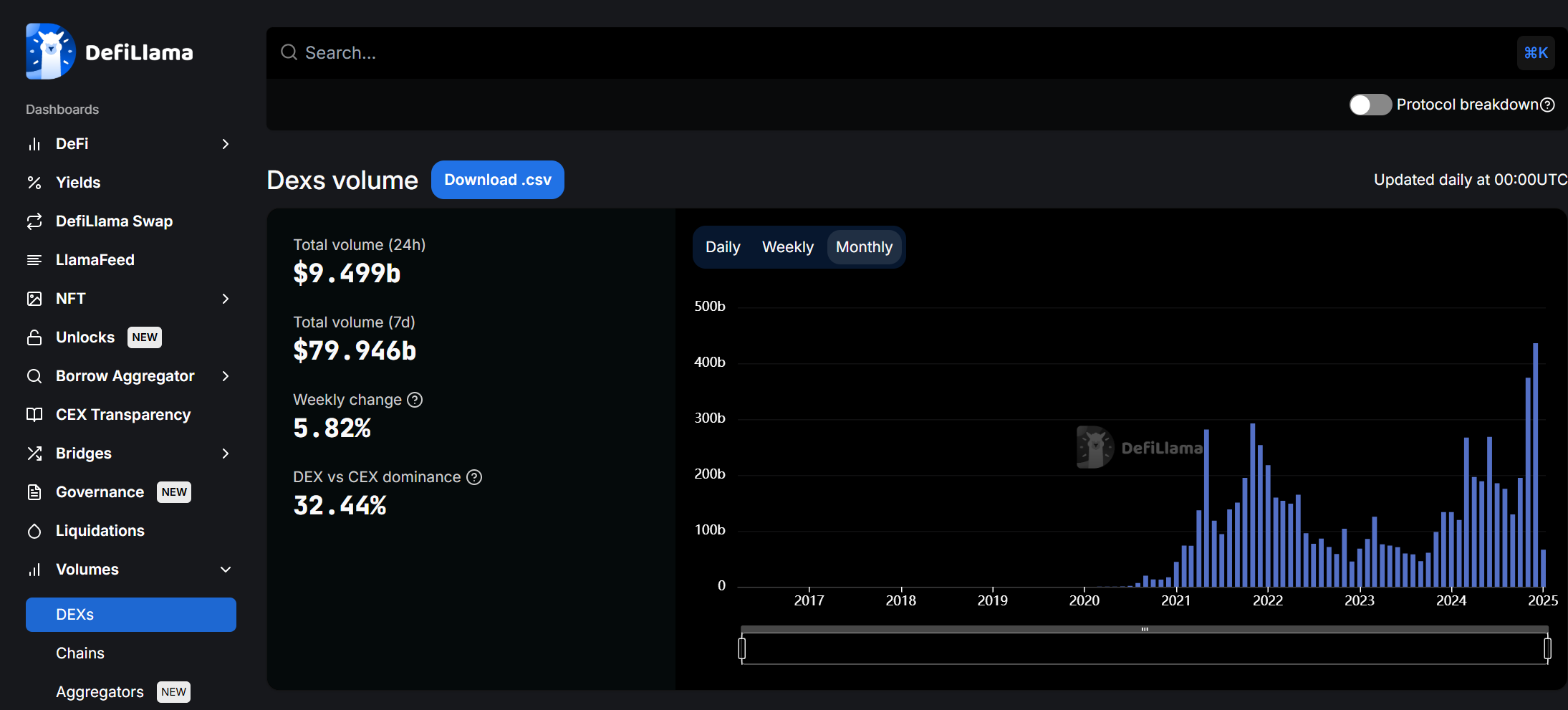

Spot trading volume on decentralized exchanges surpassed 20% of activity on centralized platforms for the first time in crypto history.

The DEX to CEX trading volume ratio is calculated by dividing monthly decentralized exchange volume by centralized exchange volume and representing it as a percentage.

Data from The Block and DefiLlama showed the DEX to CEX ratio crossed the 20% mark this week. However, the figure was based on incomplete January data and could change before February.

January’s DEX to CEX percentage is at its highest point since May 2023, when the ratio hit 14% amid a broader market recovery following the challenges of 2022.

Does the DEX to CEX % signal a crypto shift?

The 20% milestone could signal a potential shift in trading behavior as 2025 progresses. Analysts suggest this may reflect growing interest in decentralized platforms.

Launchpads that simplify launching tokens, like Pump.fun, have incentivized investor appetite for low-cap virtual assets. These assets typically trade first on DEXs after launch.

Major centralized exchanges like Binance, Coinbase, and Kraken provide web2-style access to digital assets. However, they are slower to list new coins, often waiting weeks or months before adding them in limited batches.

Decentralized platforms such as Uniswap continue to play a significant role in crypto trading. DEXs align more closely with the decentralized ethos and support new token launches without restrictions. On-chain data shows that decentralized exchanges have generated nearly $10 billion in trading volume since the start of the year.

7-day DEX trading volume – Jan. 7 | Source: DefiLlama

7-day DEX trading volume – Jan. 7 | Source: DefiLlama

By crypto.news | Created at 2025-01-07 16:13:55 | Updated at 2025-01-08 14:34:47

22 hours ago

By crypto.news | Created at 2025-01-07 16:13:55 | Updated at 2025-01-08 14:34:47

22 hours ago