The Official Opposition condemned Trudeau’s “GST vacation,” amid calls for more meaningful tax relief. A $250 rebate cheque won’t cut it, says Pierre Poilievre, the Tory leader.

“Canadians have been through a lot — they work hard — we see that,” Prime Minister Justin Trudeau told reporters on Thursday. “Everyone has had to tighten their belts a little bit, and now, we’re going to give a tax break to all Canadians.”

Last week he proposed a two-month “GST holiday” on essentials starting December 14, as well as a $250 rebate for working Canadians earning up to $150,000.

Prime Minister Justin Trudeau announces a proposed two-month GST/HST holiday on essentials starting December 14 and a $250 rebate for working Canadians earning up to $150,000, urging all parties in the House of Commons to pass it swiftly. pic.twitter.com/h1P6RIUMou

— True North (@TrueNorthCentre) November 21, 2024Poilievre says the measure is not good enough, while Dr. Sylvain Charlebois, the “Food Professor,” called it a “token gesture.”

“Remember they said the carbon tax would make you better off, but here we are with the ‘food professor’ showing that food prices have risen 37% faster in Canada,” Poilievre said at a separate Thursday press conference.

Charlebois, in commentary to the Toronto Sun, claimed the average Canadian household stands to save just $4.51 in GST over the next two months. Canadians could save nearly $20 just by ordering takeout, he said.

Trudeau is questioned about the carbon tax increasing inflation and the cost of living and claims that most Canadians get more money back from the federal government's 'price on pollution' than it costs them. pic.twitter.com/geDJJBqkih

— Rebel News Canada (@RebelNews_CA) July 31, 2023According to the referenced report, on food affordability, “a carbon tax … inevitably leads to increased production costs for producers and manufacturing firms,” which trickles down to the consumer.

The Agricultural Producers Association of Saskatchewan (APAS) blamed the tax for increasing costs on farmers, who pay more in barn heating or grain drying each month than they see in rebates.

Next April 1, the carbon tax will rise to $95 per tonne, with a target of $170 by 2030. Fuel costs will include 37.6 cents in carbon taxes at that time.

“Undoubtedly, concerns related to supply chain disruptions, along with the consequences of global events, have significantly influenced the cost of groceries,” said the report, Implications of carbon Taxing policies on the food supply chain in Canada.

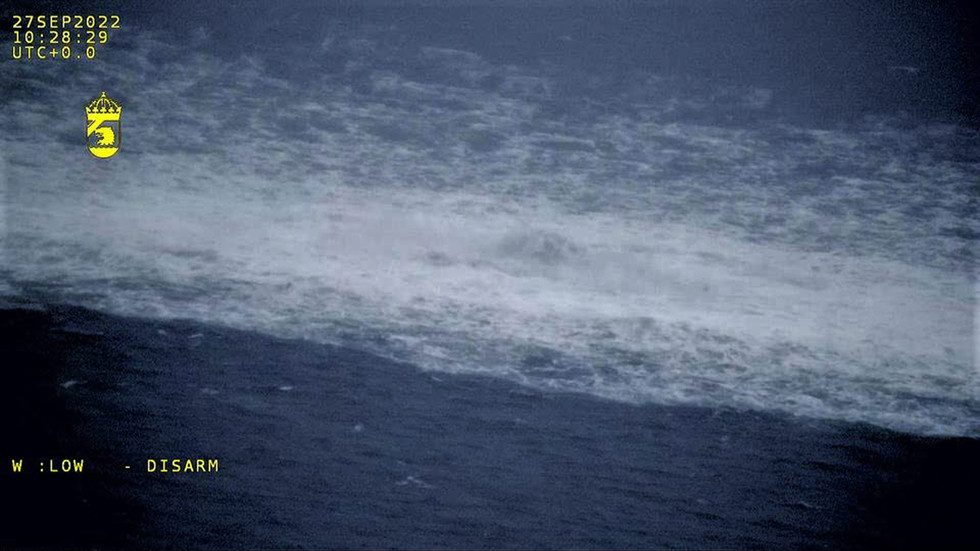

— Rebel News (@RebelNewsOnline) March 29, 2022With 8.1% inflation in June 2022, Canadians allocated 17% of their disposable income on food, it calculated. In the months that followed, food inflation reached double digits despite a cooling Consumer Price Index.

The Agriculture Committee then attributed food inflation to global phenomena, including the Russia-Ukraine war, spiking feed, fuel and fertilizer costs, supply chain interruptions and climate events.

According to the Canada Food Price Report 2024, the average family of four will spend $16,297.20 on food, a whopping $701.79 increase over the previous year. Meat and vegetables costs were slated to go up by 7%.

Another study found that a growing number of Canadians were open to eating food past its best-before date.

"Be a little more economically literate," Deputy PM Freeland tells Conservative Leader Poilievre after he highlighted Canada's struggling economy compared to the US.

"What's her message to people that are hungry and homeless after nine years of her gov't?" pic.twitter.com/WtUqiZuZjm

“Does he [Trudeau] really expect Canadians to fall for this tiny tax trick just before he quadruples the carbon tracks on heat homes, gas and groceries?” Poilievre told the House of Commons on Monday. Trudeau did not respond, while Finance Minister Chrystia Freeland did not address the rebate.

In recent months, the Official Opposition leader has urged Parliament to implement meaningful tax relief for Canadians, such as removing the GST on new homes under $1 million.

“We will axe the tax … saving up to $50,000 on a new home or lowering mortgage payments [by] $2,700 every single year,” Poilievre told MPs on October 29.

— Rebel News (@RebelNewsOnline) January 25, 2024A Parliamentary Budget Officer (PBO) note also said exempting the carbon tax from the GST would reduce federal tax revenues by $486 million in 2024. By the end of the decade, revenues would total $1 billion, should there be no tax break.

“Here’s an idea: they could save Canadians real money right now by picking up the PBO report and ending their tax-on-tax,” said Franco Terrazzano, Federal Director of the Canadian Taxpayers Federation (CTF).

The carbon tax costs the average family upwards of $710 a year after rebates, according to a separate PBO report.

Alex Dhaliwal

Calgary Based Journalist

Alex Dhaliwal is a Political Science graduate from the University of Calgary. He has actively written on relevant Canadian issues with several prominent interviews under his belt.

By Rebel News | Created at 2024-11-25 23:01:17 | Updated at 2024-11-27 12:58:22

1 day ago

By Rebel News | Created at 2024-11-25 23:01:17 | Updated at 2024-11-27 12:58:22

1 day ago