Rachel Reeves’s upcoming Budget has been tipped to include several hikes on taxes and cuts to services.

The Chancellor has been widely rumoured to be planning a reform of the tax-free relief attached to pension withdrawals in an attempt to plug the £22billion "black hole" in the public finances.

Retirement savers can currently withdraw a lump sum worth 25 per cent of their pot with the maximum amount being £268,275.

However, pundits have said this relief could be reduced or altered to increase the tax liability on pension savings.

Analysts have also warned that inheritance tax (IHT) could be made payable on retirement funds as Reeves attempts to generate revenue for the Treasury.

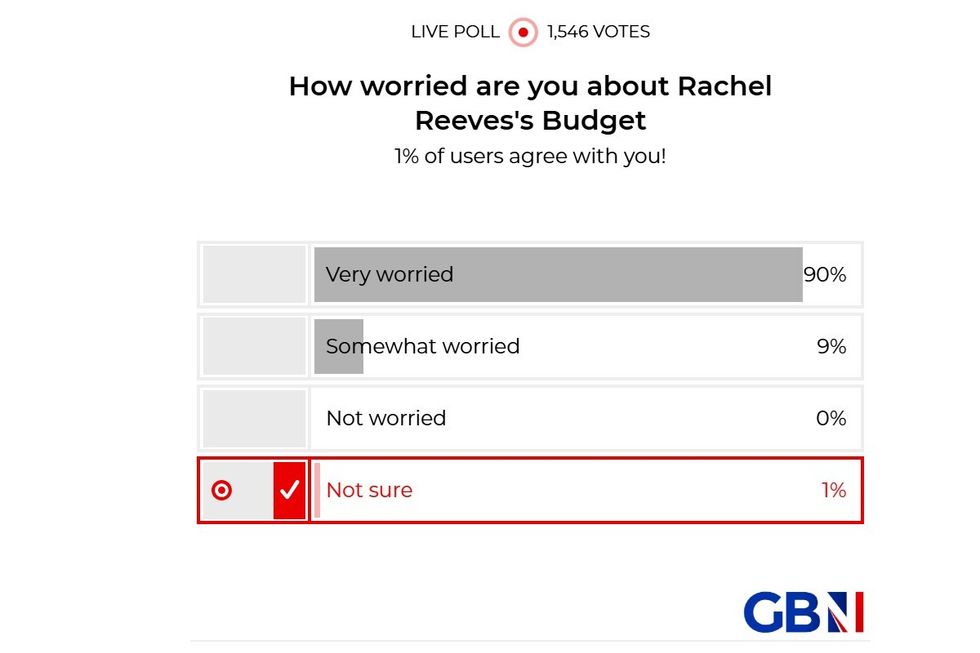

POLL OF THE DAY: How worried are you about Rachel Reeves's Budget? YOUR VERDICT

GB News

IHT is not currently paid on peoples' pensions as the value of the pot is not considered to be included in the value of an estate.

Helen Morrisey, the head of retirement analysis at Hargreaves Lansdown, outlined why the Chancellor could likely launch a "death tax" raid on pensioners later this week.

She explained: "Changing the tax treatment of pensions on death could prove a tempting target for the Government. The current system sees pensions passed on tax free if a death occurs under the age of 75.

"Deaths over age 75 see beneficiaries pay income tax on what they receive. In most cases, pensions do not attract inheritance tax.

"It’s a move that sets pensions apart from other savings vehicles and has prompted people to spend down other assets and leave their pensions to pass on to loved ones."

In the exclusive poll for GB News membership readers, an overwhelming majority (90 per cent) of the 1,546 voters said they were very worried about the Budget and nine per cent said they were somewhat worried. One per cent said they did not know.

By GB News (Politics) | Created at 2024-10-29 18:26:47 | Updated at 2024-10-30 17:28:55

1 day ago

By GB News (Politics) | Created at 2024-10-29 18:26:47 | Updated at 2024-10-30 17:28:55

1 day ago