For free real time breaking news alerts sent straight to your inbox sign up to our breaking news emails

Sign up to our free breaking news emails

Chancellor Rachel Reeves took aim at employers in her first budget, hitting them with higher taxes and raising the minimum wage, leaving young workers as the clear winners.

The minimum wage for 18 to 20-year-olds will rise 16 per cent to £10 as part of a plan to equalise the rate with older earners, while the national living wage got a 6.7 per cent top-up to £12.21 an hour.

“The most significant impact will be on 18-20 year olds, who will see the largest increase to the National Minimum Wage on record,” said John Harding, a partner at accountants PwC.

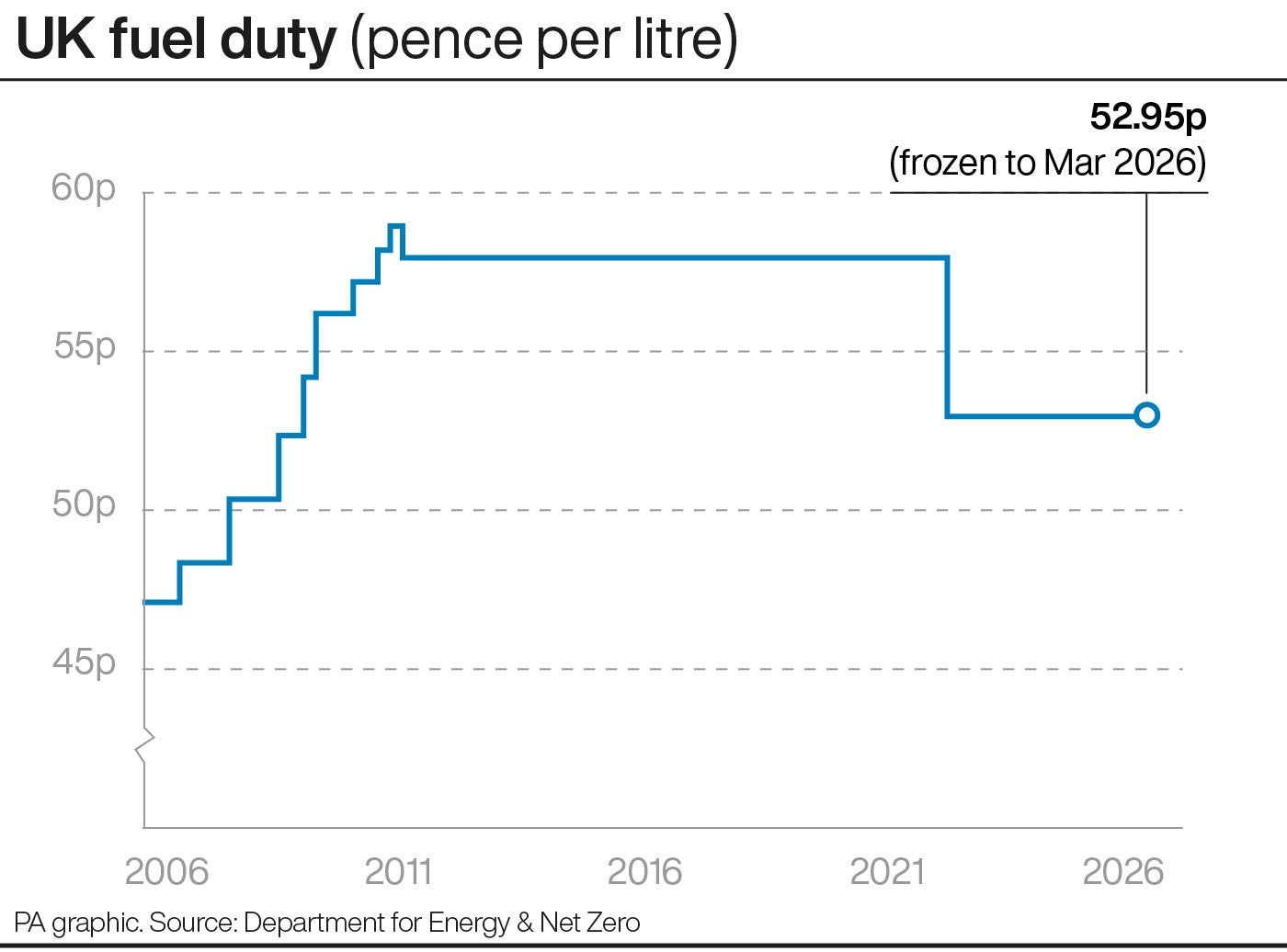

Drinkers will also enjoy a penny off draught pints and duty on petrol has been frozen again.

The picture is darker for the better-off, on whose shoulders the chancellor warned the biggest burden will fall.

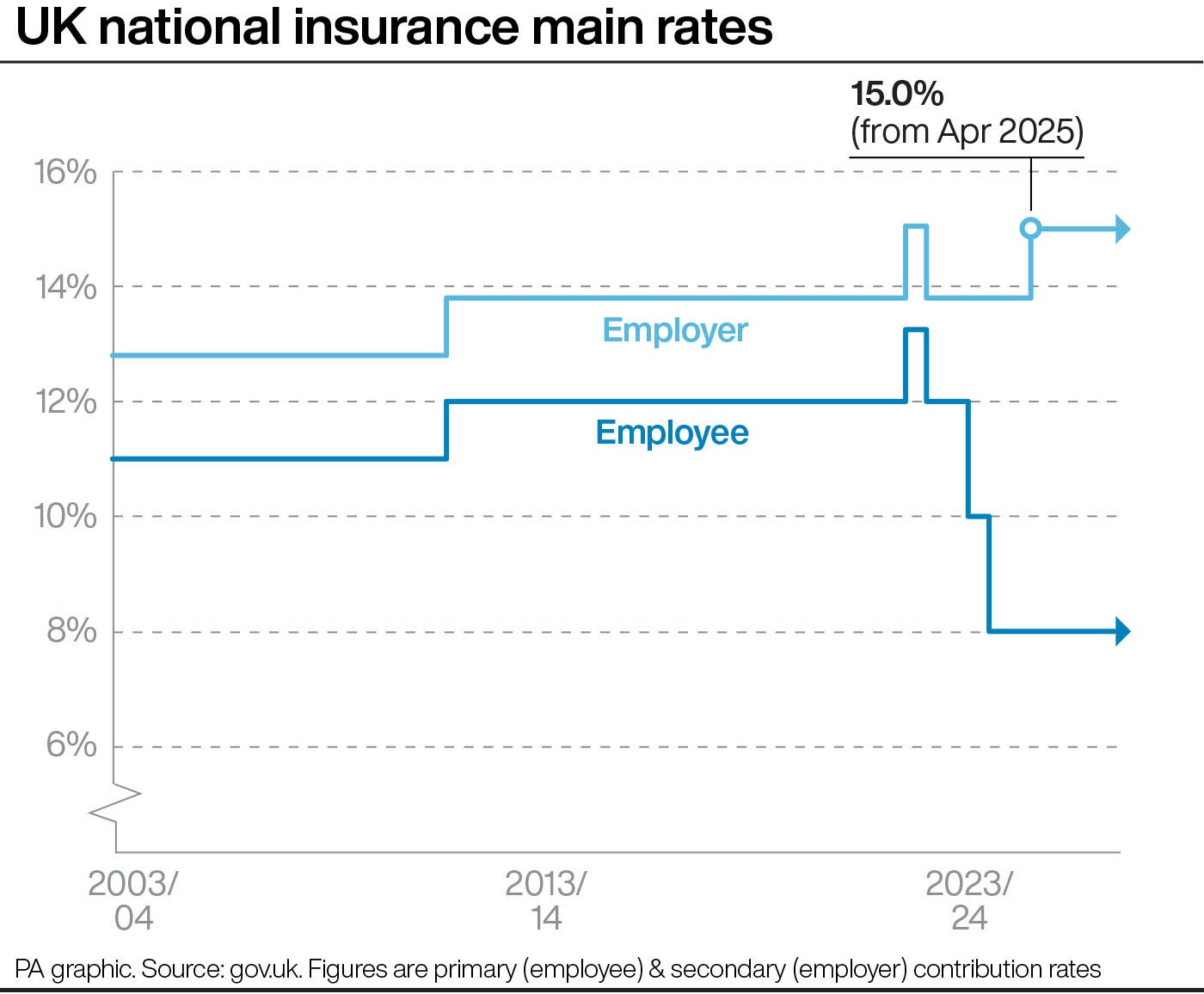

Gains on shares and other investments will be taxed more, as will second homes. Businesses face a 1.2 percentage point increase in employers’ national insurance, to 15 per cent, in a bid to raise £25bn. Ms Reeves also lowered the threshold on which the tax is paid.

“I know this is a difficult choice,” she said, adding: “I do not take this decision lightly.”

Business groups complained that the move could mean slower hiring, more firing or trimming other expenses, hitting employees in the long run.

Martin Willis, partner at independent consultancy, Barnett Waddingham said: “The real losers here will be those at the receiving end of any cost-cutting exercises employers may take. Businesses will have to recoup the savings made on this relief from somewhere, with employer pension contributions potentially in the firing line.”

Aside from wages, there are a whole host of other changes that will affect the purse strings of households up and down the UK.

The budget will increase inflation and interest rates by a small amount, according to the Office for Budgetary Responsibility. Inflation will be 0.4 percentage points higher in 2026, while interest rates will rise 0.25 percentage points, hitting mortgage borrowers.

Owners of shares in companies and other assets like second homes will be taxed more if they rise in value.

Basic rate tax payers will pay 18 per cent on gains, up from 10 per cent, and higher rate tax payers – those who pay 40 per cent income tax – will pay 24 per cent, up from 20 per cent. This means the rates will be the same for gains in the value of second homes.

Investors can avoid the tax by sheltering their capital in a pension or Individual Savings Account (ISA). While pensions can now be taxed on death as part of inheritance tax reform, savers have avoided the most-feared reforms.

Jason Hollands, Managing Director at money managers Evelyn Partners said: “Thankfully, there was no cut or lifetime cap imposed on ISAs – which some think tanks had called for. Nor was there a reduction in the amount of tax-free cash that can be taken from pensions, the thought of which had given many people sleepless nights.”

Only 6 per cent of estates pay inheritance tax, Mr Reeves pointed out, insisting she was taking a “balanced approach”.

The main change to the tax, which only kicks in for people with estates worth more than £325,000 (£500,000 if a home is being bequeathed to a descendant), is that land and businesses may now be caught in it, but only if they are worth more than £1m.

Second-home buyers will also pay more stamp duty with rates rising from 2 per cent to 5 per cent.

In smaller moves, air passenger duty will rise, adding £2 to the cost of an economy trip to Europe, and cigarettes will increase in price at 2 per cent above inflation. Drinkers who prefer bottled beer, wine or spirits will

Higher earners do have one thing to look forward to – an eventual rise in tax bands, which will rise by inflation, but only from 2028.

Already announced was the bus fare cap, which limited a ride to £2, and will be raised to £3.

VAT will be paid on private school fees from the new year, adding 20 per cent to the bill for parents unless schools are able to swallow some of the difference.

Winter fuel payments, which went to all pensioners, will now only go to the least well-off, including those receiving pension credit.

The state pension will rise by 4.1 per cent in April to £230.30 a week for the new, flat-rate state pension.

Taxpayers may feel they have received the thin end of the wedge with £22.6bn going to the health budget and £3.1bn in capital investment, but Ms Reeves said she wants to make tax rises and spending cuts equalling £40bn in order to improve the country’s financial health. She said she is seeking to avoid austerity.

The borrowing rules are also set to change. Ms Reeves will use a different measure of national debt, allowing her to borrow more to spend on infrastructure, like energy schemes, schools and hospitals.

Doing so should offer a boost to the economy, raising more tax from growth and paying off the debt faster.

By The Independent (Business) | Created at 2024-10-30 16:44:21 | Updated at 2024-10-30 19:23:31

2 hours ago

By The Independent (Business) | Created at 2024-10-30 16:44:21 | Updated at 2024-10-30 19:23:31

2 hours ago