Grieving military families are set to have their financial compensation slashed by Labour’s inheritance tax crackdown, analysis has revealed.

Death in service payments are currently awarded to the families of deceased servicemen and women in tax-free lump sums as compensation for the loss of a family member.

But changes to inheritance tax rules, voted for by Labour, will see these payments subjected to inheritance for the first time.

There are exceptions, namely the fact the new death duties will only kick in if the serviceman or woman dies while ‘off duty’, which could include illness or accident.

Also, the tax won’t apply to payments being made to spouses or civil partners.

But it will apply to payments being made to children or unmarried partners of the deceased.

It means children or long-term but unmarried partners whose parent/partner recently died while serving their country will receive significantly less money than they would have previously.

Payments are usually four times the deceased’s salary, but under Labour’s crackdown could be taxed by up to 40 per cent.

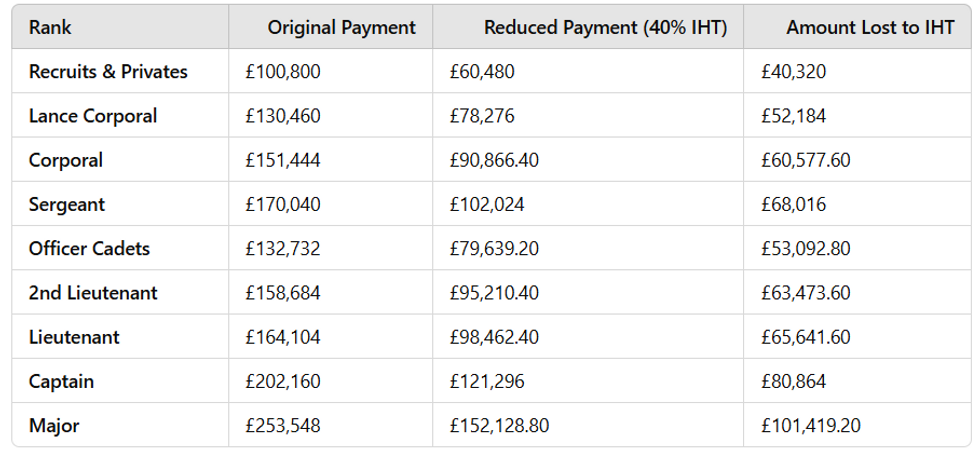

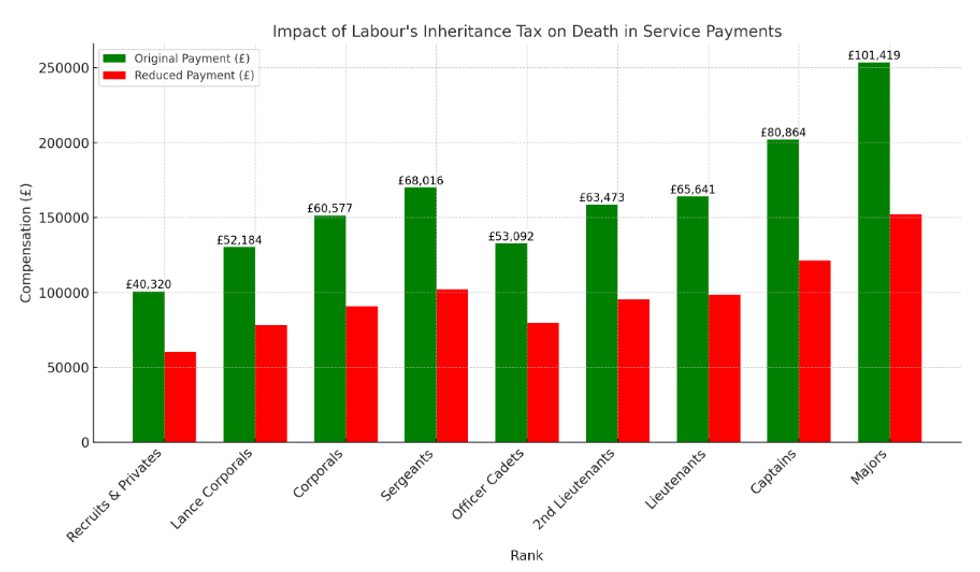

By taking the salaries of different ranks in the British Army, multiplying them by four and then subtracting 40 per cent for IHT, we can see the financial implications of Labour’s policy. (All salaries are starting salaries taken from British Army website).

Possible effects of Reeves' IHT on armed forces 'death in service' payments

GBN

Potential impact of Labour's IHT on death in service payments

GBN

It shows for a Lance Corporal earning a salary of £32,000, his family would have been paid £128,000 in the event ofhis death, but will now receive £78,276, a loss of £52,184 to the Treasury.

For a deceased Second Lieutenant, his family would have received a £158,684 payment, but will now receive £95,210.40, a loss of £63,473.60 to the Treasury.

Commentators have highlighted how the Armed Forces are vulnerable to the government as they do not have a powerful union protecting their interests.

Take ASLEF, the train drivers’ union, as an example. According to electoral Commission records, ASLEF has historically donated £922,252 to Labour and its politicians, £380,648 of which was trousered in the last four years.

Within months of taking office, Labour had awarded train drivers an inflation busting pay rise, to go with generous pension schemes.

Critics have also slammed the decision as short-sighted as international tensions continue to rise with China and Russia pursuing increasingly expansionist policies.

LATEST FROM MEMBERSHIP:

Major General Neil Marshall, the chief executive of the Forces Pension Society, has penned a letter urging the Government to reverse the decision.

Marshell said: “If service people are thinking ‘What if? What if? What’s the Government going to do next to undermine the offer to undermine my commitment to service?’ It’s corrosive.

“Given the high-risk nature of military service and the need for all serving personnel to be focussed on the mission while being treated fairly and equally, irrespective of their marital status, a policy that discriminates against those who are not married or in a civil partnership poses a serious threat to morale, team cohesion and ultimately operational effectiveness.”

Tory MP Mark Francois, shadow Armed Forces minister, said: “Labour’s proposed inheritance tax changes are already highly controversial, particularly within the farming community.

“However, it is deeply regrettable and completely against the spirit of the Armed Forces Covenant that Labour MPs voted to impose inheritance tax on death in service lump sum payments for unmarried service personnel.

“The Forces Pension Society, who are the gold-standard experts on this topic, have called for this change to be reversed, which it undoubtedly should be.”

A spokesman for the Treasury said: “We value the immense sacrifice made by our brave Armed Forces, that is why existing inheritance tax exemptions will continue to apply, meaning that if a member of the Armed Forces dies from a wound inflicted, accident occurring or disease contracted on active service, they will be exempt.

“Any pension funds left to a spouse or civil partner in this scenario will also be exempt.”

By GB News (World News) | Created at 2025-01-26 06:06:08 | Updated at 2025-01-27 04:12:23

22 hours ago

By GB News (World News) | Created at 2025-01-26 06:06:08 | Updated at 2025-01-27 04:12:23

22 hours ago