The staggering scale of Gordon Brown’s blunder when he sold off Britain’s gold has been revealed.

The Former Labour Prime Minister flogged 395 tonnes of Britain’s gold reserves between 1999 and 2002, despite historically low prices and a raging bear market.

Brown, who was then Chancellor, sold it to invest in foreign currency, namely the euro, arguing gold value was ‘too volatile’, though commentators at the time said it was Labour showing support for the EU’s new currency.

The sale raised $3.5billion (£2.7 billion), but the price of gold has since increased at an average of 8 per cent annually in the 25 years from 1999–2024.

Gold has been surging in 2025 too, touching $3,000 per ounce for the first time ever last week and peaking at $3,053 per ounce today.

The price of gold has increased tenfold since Brown sold it off

The price of gold has increased tenfold since Brown sold it off

BullionVault

Is that a big number?

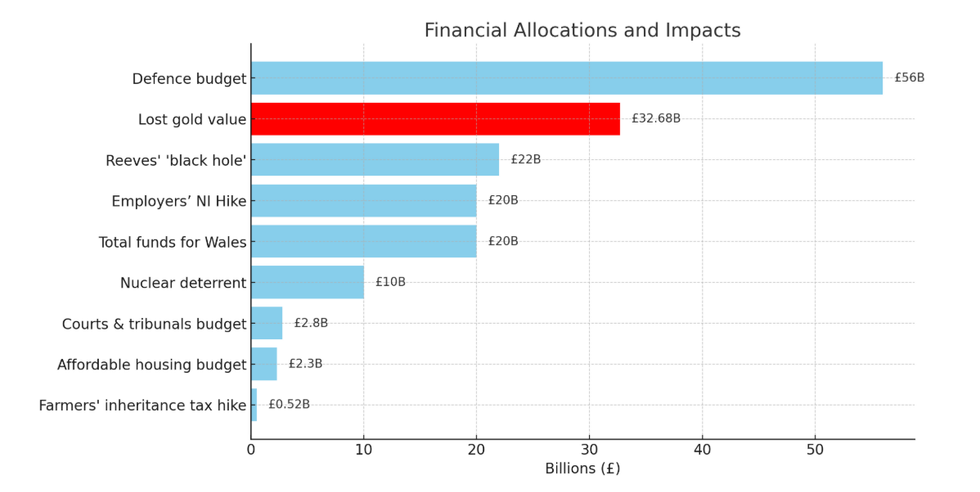

Had Brown not sold off that gold, that 395 tonnes (approximately 13.93 million ounces) would now be worth $42.5billion (£32.68 billion).

£32.68 billion is, obviously, a large number. It’s 14 times more than the government’s total expenditure on affordable housing last year (£2.3billion), and 11.6 times more than the government’s total expenditure on courts and tribunals last year (£2.8billion) which are dogged by huge backlogs.

It’s also enough to fill the ‘£22billion black hole’ Labour claimed to find in its finances when they took power one and a half times over.

In terms of the bigger spending departments, that gold could have covered 10.2 per cent of last year's welfare budget (£313billion- the biggest area of government expenditure), 15.9 per cent of the health budget (£201billion) or 34 per cent of the education budget (£94billion).

Looking at it from the point of view of recent measures introduced by Reeves in her bombshell budget, the lost gold’s value is 62.8 times more than the government expects to raise by slapping farmers with inheritance tax (£520million by 2030).

The £32.68billion would also have been enough to keep the nine million British pensioners who lost their winter fuel payment warm for the next 12 winters.

What the lost gold value could buy today

What the lost gold value could buy today

GBN

The staggering sum would also have been enough to compensate every WASPI woman 4.5 times over (based on compensation of £2,000 per woman).

Labour’s Employers’ National Insurance hike, Reeves’ biggest budget measure, will rake in £20billion a year for the Treasury, £12billion less than the gold value.

The slashing of welfare payments Liz Kendall just unveiled is worth £5billion, a figure that could have been saved five times over if the gold was sold today.

In terms of what the lost gold’s value could buy, the government could hire 1million new nurses, 990,000 junior doctors and 466,000 new GPs.

It could also buy 531 F-35 Fighter Jets (roughly $80million each)- one of the most advanced aircraft in the world- increasing the UK’s total fleet of the fifth-generation fighters 15 times over.

Similarly, the gold could now buy 1,000 Apache Attack Helicopters (increasing Britain’s fleet of 50 twenty times over) and 7,780 Challenger 2 tanks or hire 1.3 million new soldiers.

It could also have paid for 3.4 million yearly PIP payments, 6.9 million yearly Universal Credit payments (for over 25s) or 544 million ten-minute GP appointments.

Former Chancellor Kwasi Kwarteng said earlier this year: "The sale of the gold at rock bottom prices was a huge blunder.

"We should never have sold it and if we hadn’t we should still keep it regardless."

Reform UK leader Nigel Farage echoed Kwarteng’s comments also branding the sale “disastrous”.

Conservative Shadow Chancellor Mel Stride told GB News: “Labour Governments always end up squandering taxpayers’ money and this one is no different.

“Sadly even the gold Gordon Brown sold off wouldn’t be enough to touch the sides of the black hole Rachel Reeves has created - in fact it would not even cover the extra interest spending on the debt she is racking up.

“We are all paying the price for Labour’s incompetence.”

LATEST FROM MEMBERSHIP:

Brown's gold sell off could have bought the UK 530 F-35 fighter jets or hired 1 million new nurses

Getty

However defending the sale, IEA Economics Fellow Julian Jessop told GB News that "hindsight is a wonderful thing", saying: "Gordon Brown’s decision made some sense at the time because gold had performed poorly as an investment for many years.

"The launch of the euro also provided an opportunity to diversify the UK’s reserves into a new currency which was widely expected to rival the US dollar.

"Moreover, the proceeds from the gold sales were reinvested in assets that paid interest, generating some additional income.

"This has only offset some of the capital gains that the UK might have made if still holding all the gold, but the Government should not really be in the business of speculating on commodity markets.

"Finally, this is largely irrelevant to the current mess anyway, for two reasons.

"First, while these sales would raise cash and reduce the amount of bonds that needed to be sold, this would be a one-off.

"The 'black holes' in the public finances are not just a single-year problem.

"Second, and more importantly, the disposal of an asset would not actually help to meet the Government's fiscal targets, which require day-to-day spending to be covered by tax revenues, and net debt to be falling.

"Overall, selling gold would not be a long-term solution to Britain’s fiscal crisis."

By GB News (World News) | Created at 2025-03-20 17:31:02 | Updated at 2025-03-21 07:52:50

14 hours ago

By GB News (World News) | Created at 2025-03-20 17:31:02 | Updated at 2025-03-21 07:52:50

14 hours ago