With Bitcoin (BTC) roaring to new record highs, the momentum has elevated the wealth profile of long-term holders, including anonymous founder Satoshi Nakamoto.

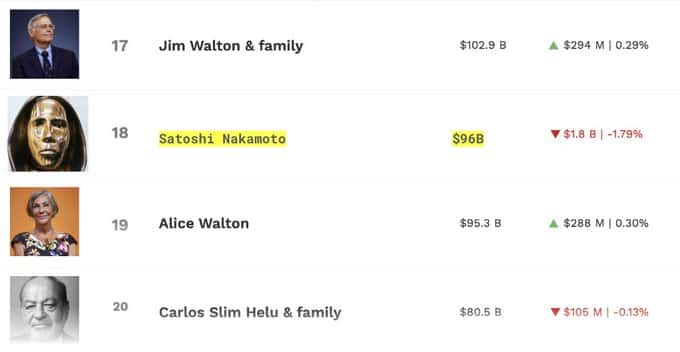

To this end, Nakamoto’s wallets, with about 1 million BTC holdings, translate to a net worth of above $96 billion, ranking him as the 18th richest person in the world. This wealth places him just behind the owners of Walmart (NYSE: WMT) Jim Walton and his family, who have a net worth of $102.9 billion.

The fortune places Nakamoto above prominent billionaires such as Alice Walton and Carlos Slim Helu in net worth rankings.

Wealthy individuals ranking. Source: Bitcoin Historian

Wealthy individuals ranking. Source: Bitcoin HistorianIt’s worth noting that Bitcoin wealth, like Nakamoto’s, differs from stock-based fortunes as it’s tied to a decentralized asset mainly influenced by market demand.

Unlike stocks, Bitcoin generates no income, such as dividends. While stock wealth has historically been associated with stable investments in established companies, Bitcoin’s value remains speculative.

However, proponents maintain the asset is on a path to maturity as it finds more use cases in the traditional finance sector.

Bitcoin millionaires spike

Besides Nakamoto, other long-term Bitcoin holders have also seen their wealth grow with the recent rally. As of November 21, a total of 153,139 Bitcoin wallets held over $1 million, including 139,124, with balances exceeding $1 million and 14,015 holding over $10 million, according to data retrieved by Finbold from BitInfoCharts.

Bitcoin holdings distribution. Source: BitInfoCharts

Bitcoin holdings distribution. Source: BitInfoChartsTherefore, the number of Bitcoin millionaire addresses increased by almost 60% in 2024, compared to 96,736 at the start of the year.

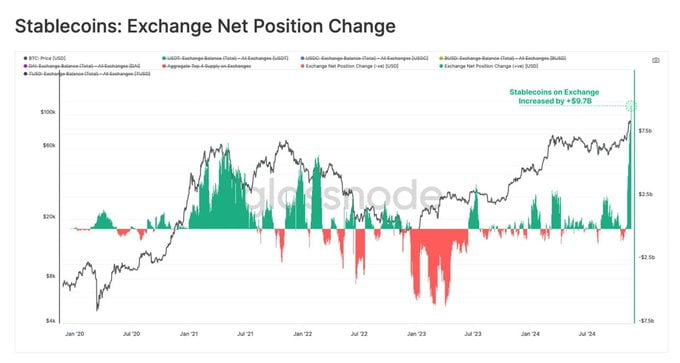

Notbaly, the wealth of these holders is also expected to grow as Bitcoin with markets anticipating Bitcoin will make additional highs, an element backed by on-chain metrics indicating a possible surge in buying pressure. Specifically, in November, $9.7 billion in stablecoins entered the cryptocurrency market alone.

Stablecoins exchange net position change. Source: Glassnode

Stablecoins exchange net position change. Source: GlassnodeStablecoin inflows into the market have been known to be a gateway to accessing different assets. With Bitcoin surging, the fear of missing out (FOMO) might kick in, driving the asset to the $100,000 milestone, which analysts such as Bernstein believe is inevitable.

At the same time, technical indicators and past historical performance suggest that Bitcoin is likely to target a high of $135,000.

Generally, the Bitcoin rally has been inspired by Donald Trump’s election. Trump is expected to push for the implementation of cryptocurrency-friendly policies, such as making Bitcoin part of the strategic reserve.

Bitcoin price analysis

By press time, Bitcoin was trading at $97,950, having gained over 4% in the last 24 hours. On the weekly chart, BTC has surged about 7%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: FinboldFinally, Bitcoin looks primed to clinch the $100,000 mark, but there are key price levels to watch. In this case, the $95,000 support will push the asset to a new all-time high.

Featured image via Shutterstock

By Finbold | Created at 2024-11-21 21:23:46 | Updated at 2024-11-23 01:47:28

1 day ago

By Finbold | Created at 2024-11-21 21:23:46 | Updated at 2024-11-23 01:47:28

1 day ago