Bangkok —

For many countries in Southeast Asia, Chinese investment and tourism are key to their economies. However, cheap low-quality Chinese products that are flooding markets across the region are also raising concerns about how they are undercutting local businesses, experts say.

That is forcing countries like Thailand to find ways to combat onslaught of low-priced goods.

Last year, bilateral trade between Thailand and China was more than $126 billion, with direct Chinese foreign investment heavily contributing to the Thai economy.

Three of Thailand’s main economic industries are manufacturing, agriculture and services. But manufacturing has seen a decline, with 2,000 factories closing in 2023, leading to thousands of jobs lost, according to data from the Department of Industrial Works.

Business owners have long bemoaned the fact that low-quality Chinese goods are undercutting local Thai businesses.

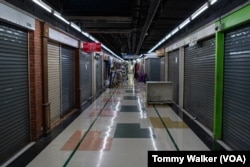

Bobae Shopping Mall – a retail and wholesale market in Bangkok – is one of the places where that impact is showing. With seven floors dedicated to shopping units, many have their shutters down, even though Thailand is in its peak season and Christmas is next week.

Banchob Pianphanitporn is the owner of Ben’s Socks, which is located on the fifth floor. He has owned the business for 26 years and manages four units. He has one factory in Thailand that employs 24 staff in total.

He said that over the last decade, his sales have dropped by half because of Chinese imports.

“I would say [sales are] 50% down since 10 years ago,” he told VOA.

“I sell socks for 150 baht ($4.38) per a dozen, but if this was a Chinese product, they would sell at 85 baht ($2.48). If [customers] have low budget they will say [my socks] are expensive. They don’t consider the materials, [my socks] are much better material and more flexible,” he added.

Thailand’s slow manufacturing industry has contributed to a sluggish year for the economy. Forecasts project that Thailand’s economic will grow by 2.3% – 2.8% percent in 2024, which is less than its regional neighbors. Although the Bank of Thailand forecasts a 3% growth in 2025, concerns from business owners remain.

Banchob points to several closures of units in his mall, blaming Thailand’s economy. But in an effort to remain open, he promotes his business on social media to attract more customers.

“Social media is a must. I’m on TikTok; I make much content. I have to work harder to tell people I’m still alive; Ben Sock’s made in Thailand is here,” he added.

According to Thai government spokesperson Sasikarn Wattanachan, there has been a 20 percent decrease in low-quality imports in Thailand since July. Authorities have introduced tighter inspections of cheap imports, focusing on agricultural, consumer and industrial items. Thailand has also added a 7% value added tax on goods imported that are under 1,500 baht or $43.77, the Bangkok Post has reported.

But for other sellers and store owners, they don’t see any difference.

Pam, a seller at Pretty Baby, a baby clothes store in the Bangkok mall, says the seemingly unlimited stock from Chinese manufacturers has affected sales. Pam did not want to disclose her full name fearing retaliation for speaking with the press.

“[Chinese products] are selling a lot, but we don’t have that much stock. The government still allows the products from overseas. Our sales have dropped down a little bit,” she told VOA.

For some customers, retaining regular customers is key to beating cheaper alternatives.

Prang is part-owner of V.C. shop, a clothing store which specializes in loose-fitting clothing known as elephant pants.

“The hard advertising from Chinese people [on social media] has had a big effect," she told VOA. Prang too did not want to give her full name.

“Pants can sell here for 70 baht ($2.04) but Chinese sell for 50 baht ($1.46). In the past we can tell [the difference] between Thai and China products, now China copies look 99 percent the same. We cannot fight with the costs, but we are confident on our material and quality, and we can keep our customers,” she added.

It’s not just Thailand that is trying to reduce low-quality imports. A growing number of countries across Asia are looking for ways to protect local manufacturers and trade.

In India, a proposed temporary tax of 25% on steel imports is likely to be imposed to curb cheaper alternatives from China and boost production from Indian manufacturers, the Reuters news agency reported on December 17.

And in Indonesia, protests against Chinese imports have prompted Jakarta to propose a 200% tariff on certain imported clothing and ceramic goods, to protect small and medium enterprises.

Vietnam also relies heavily on China in trade. Beijing is Hanoi’s largest trading partner, with bilateral trade amounting to more than $171 billion in 2023. Although both governments share communist ideologies and a 1,287-kilometer land border, Vietnam is also acting to combat China's cheap imports.

In late November, Hanoi banned Chinese online retailers Shein and Temu after the two companies failed to meet a business registration deadline with the Vietnamese government. But local businesses in Vietnam have long voiced concern over discounted products and the sale of counterfeit items from the retailer.

“Cheap Chinese imports from platforms like Shein and Temu are flooding Vietnam’s markets, squeezing local producers and sparking outrage over unfair competition,” Nguyen Khac Giang, Visiting Fellow at ISEAS, told VOA.

“In response the government is cracking down by scrapping VAT exemptions, tightening oversight, and banning platforms which do not register in Vietnam. It’s a bold move to rein in Chinese e-commerce giants and defend local businesses, but I think the fight is far from over,” he added.

Zachary Abuza, a professor at the National War College in Washington who focuses on Southeast Asia politics, says both Thailand and Vietnam may also have another motive.

“China produces on an economy of scale that no one in Southeast Asia can, their productions costs are lower for most products. I think what you see Thailand and Vietnam doing now is trying to court Chinese investment for local production, to create local product ecosystems. But neither is willing to take China head on and accuse them of unfair trading practices,” he told VOA.

By Voice of America (Business) | Created at 2024-12-18 21:44:37 | Updated at 2024-12-22 21:51:58

4 days ago

By Voice of America (Business) | Created at 2024-12-18 21:44:37 | Updated at 2024-12-22 21:51:58

4 days ago