Chancellor Rachel Reeves announced her historic budget yesterday after months of intense speculation to a feisty House of Commons Chamber.

Headlines included increasing UK Government spending by £70 billion annually, funded in part by a whopping £40 billion worth of tax rises, the biggest single increase since records began.

But Labour's aim of achieving the best sustained growth in the G7 already look to be jeopardy after the OBR-Britain's tax and spending watchdog- downgraded UK forecasts, partly in response to Reeves' budget.

The government may have made it their mission to prioritise growth, but the OBR's ‘Economic and Fiscal Outlook’ report contains several worrying graphs endangering that mission.

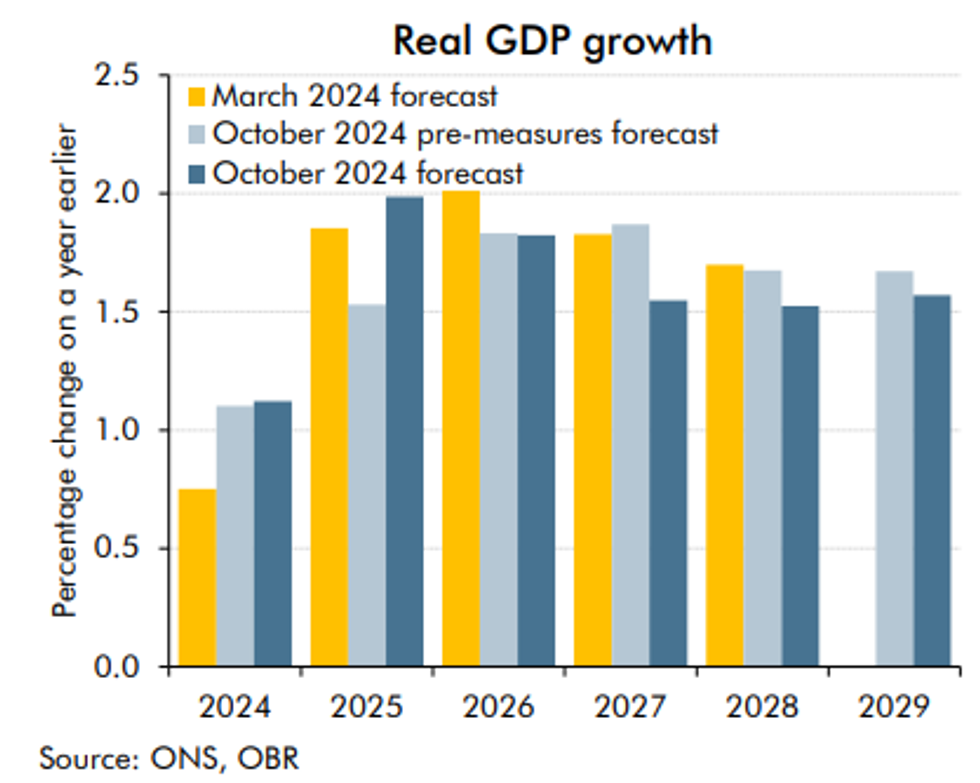

Perhaps the most worrying is a gloomy growth outlook after the short term cash injection boost wears off in 2026.

Real GDP growth forecast

OBR

The forecast clearly shows predicted growth to be lower in 2026/27/28 than it was predicted to be in March this year, a scenario Labour will desperately hope to avoid.

Speaking on Nigel Farage's show, economist Liam Halligan said: "Debt is the thick end of 100% of GDP. What does that mean?

"It means the debt that we have to pay back as a government, albeit through time, is equivalent to the size of the entire economy in a single year.

"In context, back in 2009, before the financial crisis, the national debt was about 30% of GDP, and before Covid, it was about 80% of GDP. It's now 100% of GDP.

"There's lots of talk about the sort of big picture of this budget is that Rachel Reeves just increased spending by about £70 billion a year. She increased taxation by about 40 odd billion pounds a year, most of which she tried to blame on a Tory black hole.

"So that means borrowing more of £30 billion a year. These are very, very big numbers. The size of that national debt is going to get. Bigger, the size of the national debt, it's going to get bigger.

"But also and that's as you borrow more each year, you add up all those borrowings. That is your stock, as we say, of national debt.

"And when you're borrowing an extra £30 billion a year over five years, you're borrowing an extra. Well, I did the sums. x

"She's borrowing an extra £142 billion a year over the next. Over the next five years, the market has to absorb that. The government, of course, has to borrow off investors. It can't just conjure up money. Well, sometimes it can. But she's not saying that the Bank of England is going to do that.

"And my concern is that financial markets won't be able to withstand that. They'll they'll charge the government more to borrow. That's already happening. And that will push up mortgage rates and personal loans and loans that businesses take on.

"And that won't do anything to help growth. On the contrary, that will hinder growth."

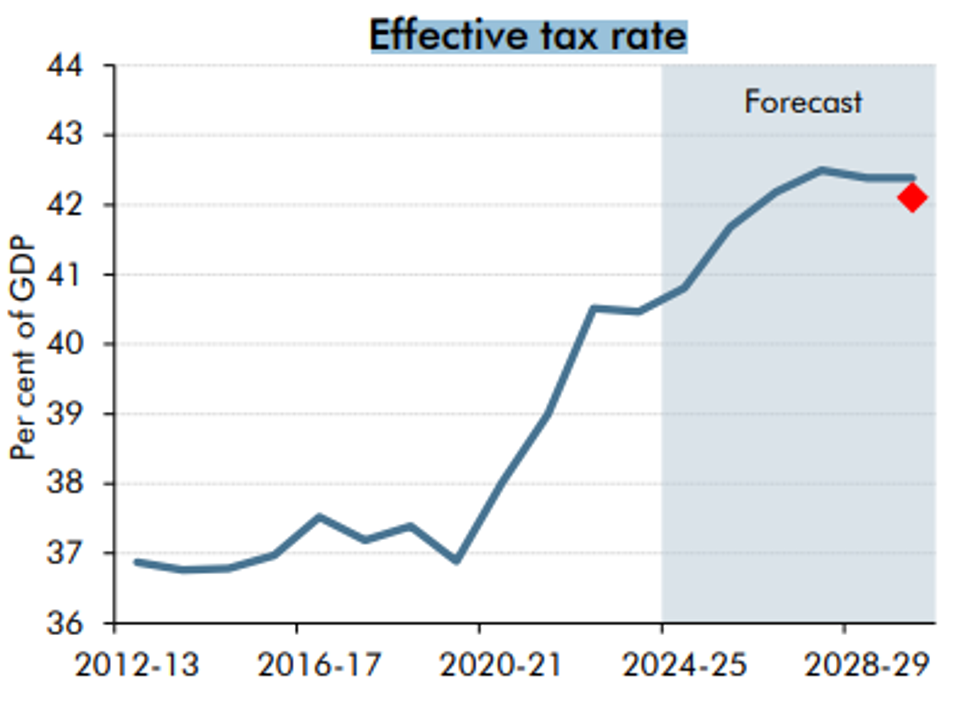

Another worrying graph for Labour shows the effective tax rate rising from its current new rate of 40 per cent to a massive 42.5 per cent by 2029, making Britain one of the most heavily taxed countries in Europe.

Effective Tax Rate Forecast

OBR

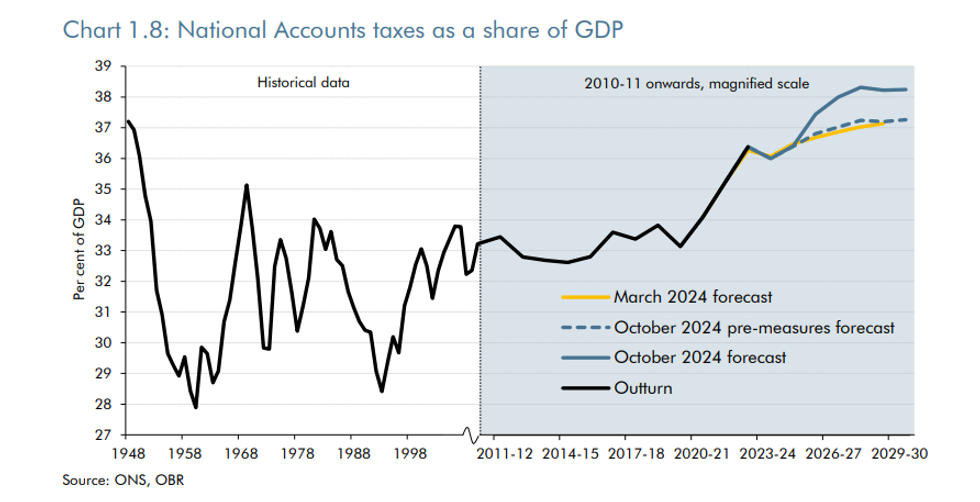

Similarly, taxes as a percentage of GDP are set to reach their highest rate ever at 38.2 per cent, up from 36.4 per cent.

This marks a rise of 1-2 per cent on the March forecast.

Reeves' £70 billion spending increase is mostly funded by tax rises, with the rest coming from more borrowing after the Chancellor changed the rules to allow the government to borrow more.

Taxes as a share of GDP

OBR

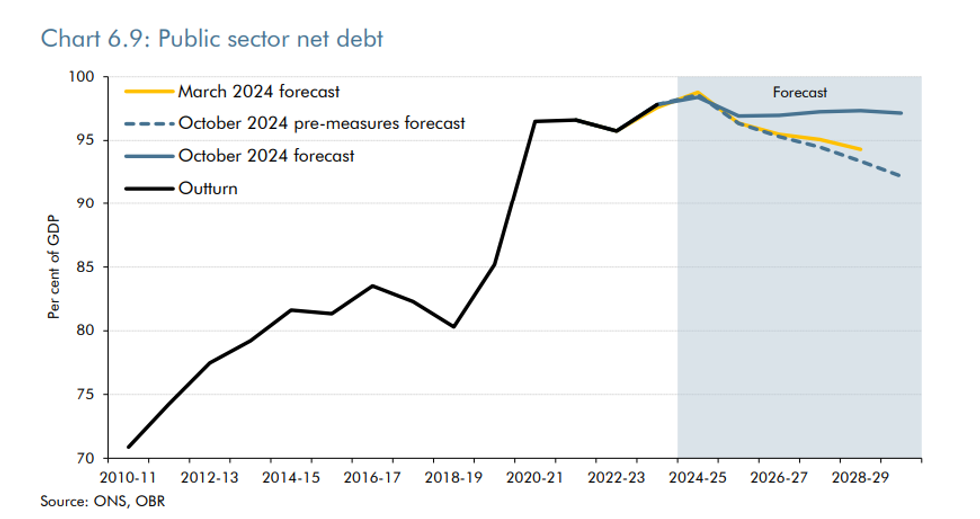

Another graph predicts public sector net debt to remain at the high rate of 97 per cent until 2029, as opposed to falling to 89 per cent as was the March prediction.

Public Sector Net debt

OBR

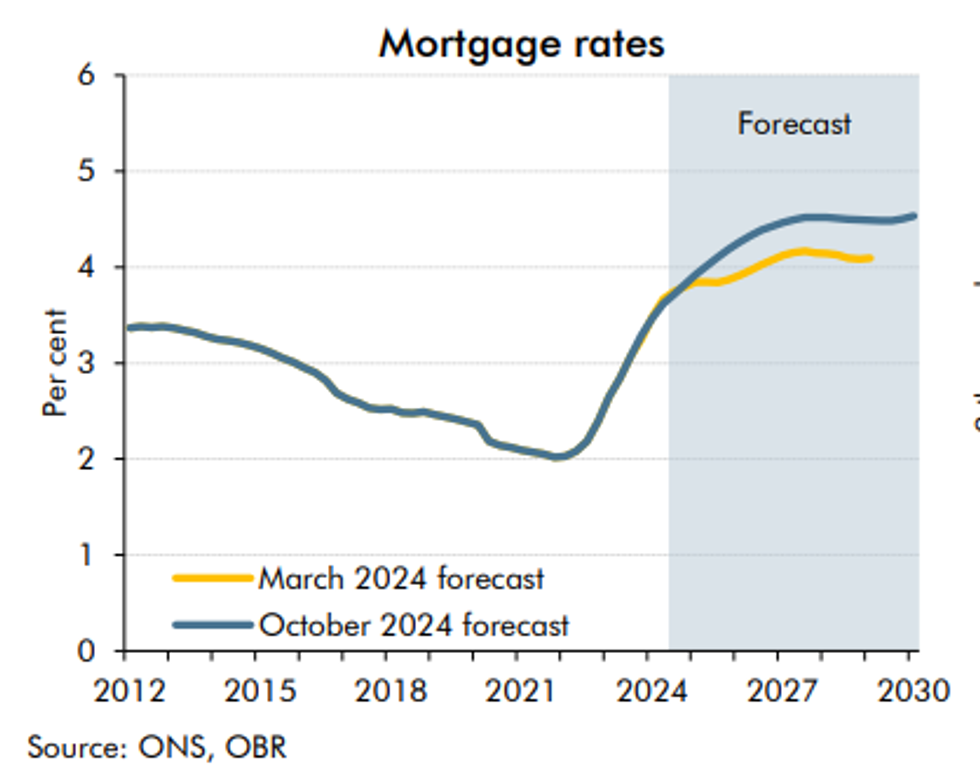

Lastly, a worrying graph has been published in relation to mortgage owners.

Though not as bad as the Truss/Kwarteng mini budget in 2022, it predicts mortgage rates to go up faster than under the Tories, up to 4.5 per cent by 2030 as opposed to the March prediction of just over 4 per cent.

Mortgage rates

OBR

By GB News (World News) | Created at 2024-10-31 10:36:27 | Updated at 2024-11-06 08:47:06

5 days ago

By GB News (World News) | Created at 2024-10-31 10:36:27 | Updated at 2024-11-06 08:47:06

5 days ago