Pensioners could be hit with more yet more financial misery as Chancellor Rachel Reeves scrambles to save her failing budget.

Reeves raised taxes by £40billion in October to fund huge cash injections for the NHS, green energy and housing projects but her plans relied in part on UK economic growth and boosted tax receipts for the Treasury.

However, the UK’s growth flatlined, something many experts attributed to Labour’s economic doom-mongering as well as ideological tax hikes that sparked an exodus of millionaires, investment and commerce.

As a result, Reeves’ fiscal headroom was eliminated, and Labour was forced to begin considering more tax rises or spending cuts.

Rachel Reeves bombshell budget raised taxes by £40billion

PA

One of the largest areas of Treasury spending in Britain relates to pensioners making it a prime target for Treasury cuts.

Labour already slashed the winter fuel payment for up to nine million pensioners, saving the Treasury an estimated £1.4billion a year, but drawing ire from a vulnerable section of society who have paid taxes all their life.

Now financial experts are weighing in on what the Chancellor could do next as she chooses which social groups must pay to get the nation’s finances back on track.

John Endacott, partner and head of tax at chartered accountancy firm Francis Clark, said: “Whilst Labour committed in their manifesto to only one fiscal event a year, and Rachel Reeves spent late last year and early this year ruling out any tax rises, it now seems quite likely that there will be tax rises and/or spending cuts [in March].

“The headroom the Chancellor allowed for in last year’s Budget wasn’t enough. It assumed the economic news would be good, events went the other way and it looks like we’ve been left exposed.

“Interest rates and inflation look set to be forecast to be higher over the medium term and so the government’s debt interest obligations will be higher, as will its spending commitments.

“Tax receipts in January set a record high – but crucially still below the forecast level.”

Endacott then outlined what Reeves could do next to save her flagging budget, and it doesn’t make fun reading for pensioners.

“My sense is that there could be another big-ticket announcement – ending the triple lock, for instance, but even then, given the level of inflation and average earnings, would that make enough of a difference? Politically, it doesn’t sound much fun.”

Currently, the state pension goes up by either 2.5 per cent, inflation, or earnings growth - whichever is the highest figure, hence why it is called the ‘triple lock’.

In April 2025, the state pension will increase by 4.1 per cent, making it worth:

- £230.25 a week for the full, new flat-rate state pension (for those who reached state pension age after April 2016) - a rise of £472 a year

- £176.45 a week for the full, old basic state pension (for those who reached state pension age before April 2016) - a rise of £363 a year

With an ageing population in Britain, the triple lock is one of the largest areas of Treasury expenditure.

It cost £124.4 billion in 2023/24 and is projected to cost £138.1 billion in 2024/25, according to the Office for Budget Responsibility.

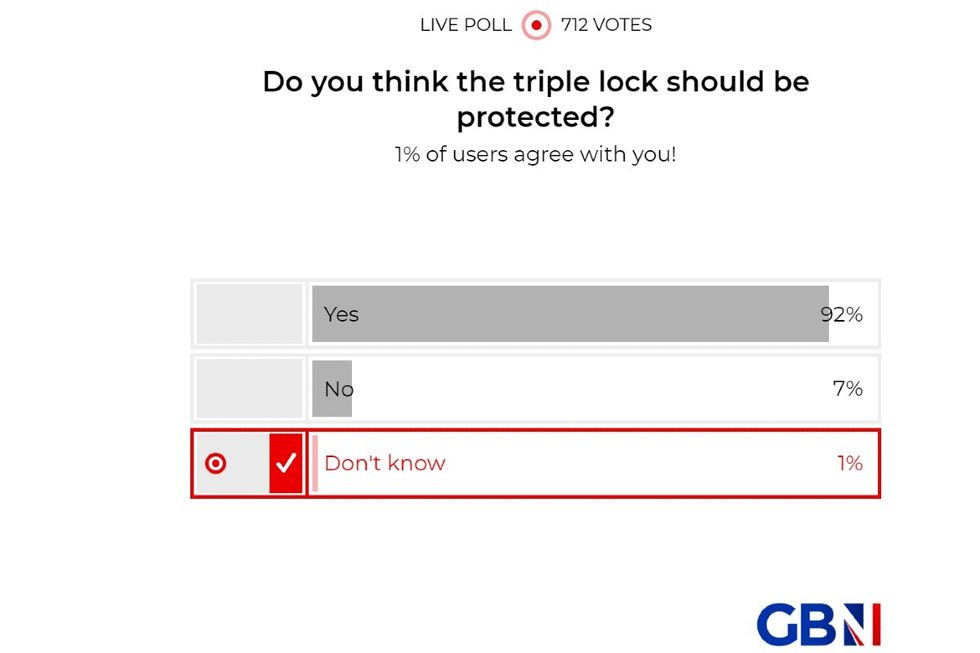

GB News' poll asking 'Do you think the triple lock should be protected?'

GB News

Endacott’s prediction of ending the triple lock could save billions for Reeves but will de deeply unpopular with pensioners who feel they have been singled out to pay for Labour’s budget thanks to winter fuel, pensions’ inheritance tax and a stealth tax on pensions.

It is a highly charged political subject as there is an unwritten rule that politicians do not attack pensioners as they can be more vulnerable, have paid taxes all their life and, very importantly, have the highest percentages of voter turnout.

Endacott continued: “One possibility is extending the freeze on allowances and thresholds further, but that would be a direct reversal of what she announced last October.

“Instead, she could look to reduce government spending on unprotected departments but that doesn’t look very credible.

“The question is whether Rachel Reeves is looking to get prudence to come out to play, or just trying to do enough to technically meet her fiscal rules.

Another deeply unpopular measure Reeves could double up on is inheritance tax.

Britain’s ‘most hated tax’ is seen as anti-aspirational and unfair as it taxes savings that have already been taxed when they were earnt, but others say it fairly redistributes wealth and reduces inequality.

“It is also worth considering ideology,” said Endacott. “This government has pursued ideological policies on private school fees and the taxation of non-doms. The inheritance tax and capital gains tax changes can be seen in a similar light.

“I think further increases in inheritance tax are possible. The government has just published a consultation document around the restrictions of agricultural and business reliefs.

“It is more accommodating than we had been indicated it might be, but it still leaves open the opportunity for the government to make additional technical changes that could increase the revenue raised from inheritance tax."

LATEST FROM MEMBERSHIP:

“We could also get a whole raft of measures designed to combat tax avoidance and a forecast increase in tax being raised by HMRC activity.

“Where is there something big enough to go after? Salary sacrifice maybe? That was certainly mooted before the Budget last Autumn but the government decided against. Could it be in the Chancellor’s sights?

“My sense is that the government will look to cut spending and may also extend the freeze on allowances and thresholds but I would expect any such measures to be accompanied by further taxation of “those with the broadest shoulders”.

“Who that is is always a matter of perspective, but we are getting the measure of this government’s ideology and if you think you are in their sights, then you probably are.”

While Reeves’ largest financial measures were announced in October, March 26 could be a momentous day for Briton’s finances as the Treasury ‘all scenarios are being considered.’

Pressed on the issue last week, Prime Minister Keir Starmer said: “In terms of the big decisions on tax, obviously the Budget was the place we took those decisions – but as ever, going into a statement, I am not going to say in advance what we might do and what we might not do.

“But let me not set hares running, the big decisions were in the Budget of last year and that’s the way we are approaching the Spring Statement”.

The Treasury has been approached for comment. A spokesperson previously told GB News: “We do not comment on speculation.”

By GB News (Politics) | Created at 2025-03-03 11:57:36 | Updated at 2025-03-03 20:55:27

9 hours ago

By GB News (Politics) | Created at 2025-03-03 11:57:36 | Updated at 2025-03-03 20:55:27

9 hours ago