Britain is on course for a recession as employers slash jobs ahead of Rachel Reeves' National Insurance rise, a think tank has warned.

Figures show the Chancellor is set to break her own fiscal rules, with the UK heading for a £4.4bn budget deficit.

Analysis of official payroll data shows the UK jobs market "is already in recession territory" following Reeves' record tax raid.

The number of people in work is falling at a pace consistent with an economic contraction.

Reeves is expected to resort to cuts to disability spending in an attempt to balance the books.

The Resolution Foundation said the jobs data adds to evidence of a deteriorating outlook for the UK economy.

GDP is projected to be 1.2 per cent lower than anticipated at the time of the Chancellor's autumn Budget. Inflation and interest rates are expected to be 0.4 percentage points higher.

Without fresh policy action, the Office for Budget Responsibility will likely revise down its projections from a surplus of £9.9bn in 2029-30 to a deficit of around £4.4bn.

This means Reeves would "be breaking her newly-legislated fiscal rules," the Resolution Foundation has warned.

Payroll data shows the UK jobs market "is already in recession territory"

PA

The Chancellor's stability rule requires the current Budget to be on course for balance or surplus by 2029-30.

Manufacturing specialists Make UK revealed that half of manufacturers have frozen hiring in the wake of Reeves's tax raids and concern about slumping orders. A quarter of manufacturing firms are considering job cuts.

The manufacturing body painted a grim picture of frozen recruitment with redundancies on the way. This comes alongside delayed or cancelled investment plans.

Make UK said: "Britain's manufacturers have hit the buffers as a wave of increasing employment taxes and wider business costs bites hard, as well as worries of a global trade war."

The organisation urged ministers to consider reforms to the business rates system to remove disincentives to invest.

Research from the Recruitment & Employment Confederation (REC) showed job listings rose just 0.1 per cent last month. This reverses a jump in available openings seen in January.

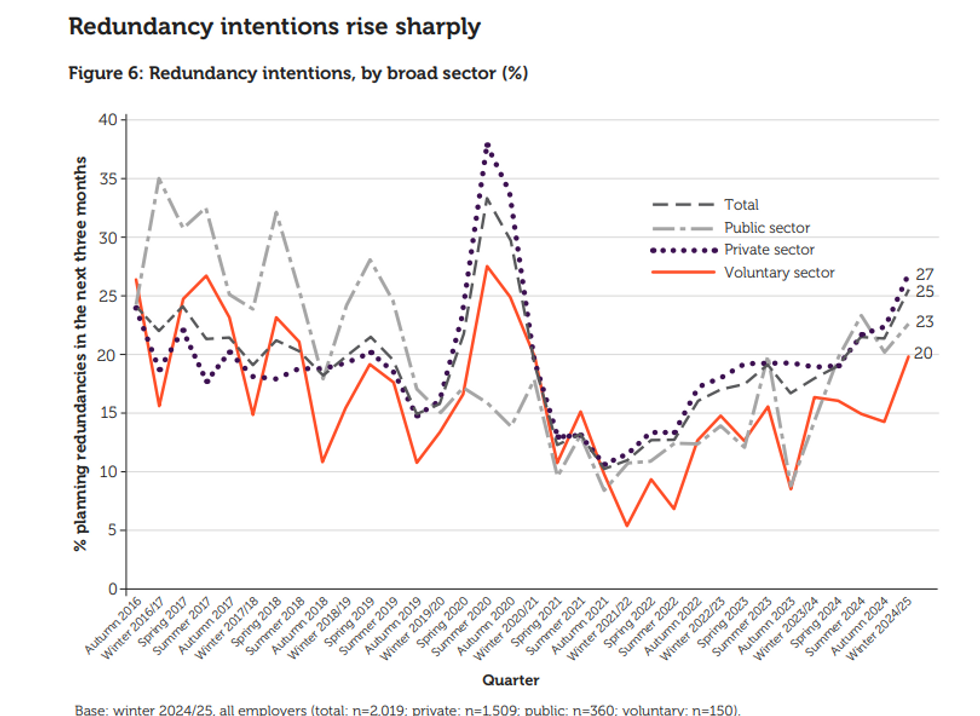

UK employers are preparing for the biggest redundancy round in a decade

CIPD’s latest Labour Market Outlook

The flat growth stokes fears that the contraction in hiring from the second half of last year may resume.

A survey by Boston Consulting Group found 57 per cent of executives now regard a recession as likely this year. This is up from 50 per cent in their previous poll.

Pessimism surrounding economic growth, consumer confidence and the business environment is more entrenched than last year.

Only companies likely to benefit from Labour's expected building boom were more upbeat.

The threat of higher taxes has emerged as the biggest concern for business, surpassing fears around increased energy bills.

Nearly two thirds of chief executives are bracing for a jump in running costs as a result of the Chancellor's £25bn increase in employer National Insurance contributions. This tax increase takes effect next month.

People in their early 50s and 60s are finding themselves out of work

GETTY

Make UK found that 48 per cent of companies have halted hiring, with more than a quarter looking at offloading staff. Four in 10 manufacturers are also set to reduce planned pay increases.

James Smith, the Resolution Foundation's research director, said turmoil in markets highlighted Britain's sensitivity to global shocks.

He warned Reeves must act decisively to reduce the risk of further damaging increases in borrowing costs.

Britain had appeared to be heading for recession in the second half of last year before the economy unexpectedly grew 0.1 per cent in the three months through December.

The Resolution Foundation suggested extending a freeze in personal tax thresholds for two years to raise £8bn.

Smith argued this would have no short-term impact on living standards as it would take effect in 2028.

He claimed 80 per cent of the revenue raised would come from the richest families. However, he described plans to cut £5bn from disability benefits as delivering no more than a "sticking plaster budget."

By GB News (Politics) | Created at 2025-03-17 08:12:13 | Updated at 2025-03-17 12:03:10

3 hours ago

By GB News (Politics) | Created at 2025-03-17 08:12:13 | Updated at 2025-03-17 12:03:10

3 hours ago