Image source, Getty Images

Image source, Getty Images

Storms and wintry weather often cause extensive damage homes and businesses.

Insurance cover and compensation can vary significantly depending on the impact and individual policy details.

Will I receive compensation if my power is cut off?

Power can be cut in thousands of homes during storms, making life particularly uncomfortable during the extreme weather.

There are rules in place that mean compensation may be paid, external by the local electricity distributor.

The level of compensation is £70, with further payments of £70 if the situation continues for a long time. However, whether this is payable, and when, depends on the severity of the situation in each area.

The Energy Ombudsman, which helps resolve disputes between customers and firms, points out that residents without power should be kept updated on the situation and on their right to compensation by their local distributor.

Do I have to go to work?

Employees are urged to contact their workplace if they have problems getting to work and employers should try to provide alternative working arrangements where possible, according to the conciliation service Acas, external.

If there is a rare red weather warning, as has been the case for Storm Éowyn, then workplaces will mostly be closed.

Acas' tips for workers affected by the bad weather include:

Informing your boss as soon as possible if you cannot get into work

Checking if there are alternative travel options

Asking about flexible working arrangements

Considering any urgent work that needs to be covered

The service also says that if you're available to work but your place of work is closed, you will usually be entitled to normal pay.

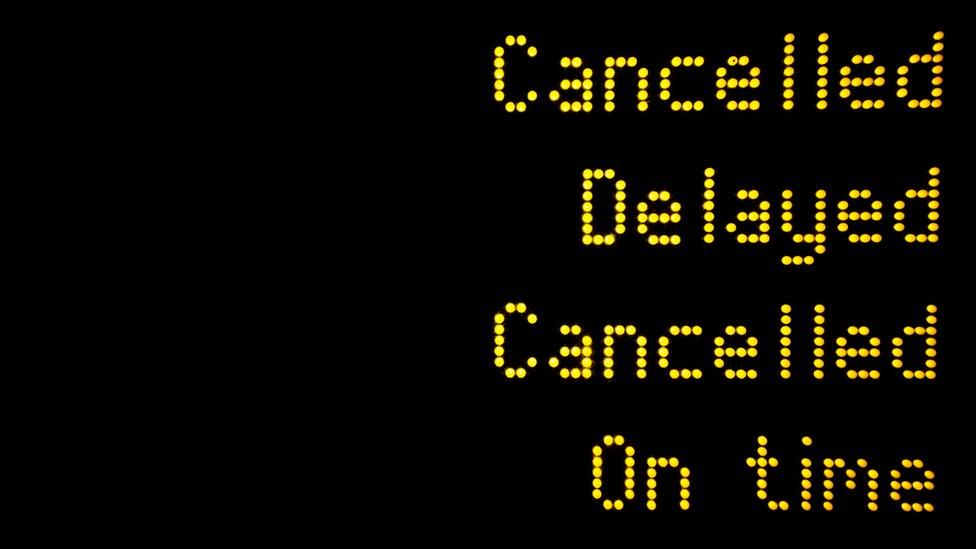

My travel plans were disrupted, what are my rights?

Rail routes may be affected by winter storms and bad weather, due to debris on the line as well as flooding. Train operating companies in affected areas will issue advice for customers.

Generally, refunds are available for cancelled trains, external, or if you do not want to travel because of the weather.

Image source, Getty Images

Image source, Getty Images

For delays, irrespective of the reason, many companies offer an automatic compensation service, although a claim still needs to be made. It can be more complicated for those with season tickets.

If you are booked on a specific service which is cancelled, then you must check with staff instead of simply getting on the next available train to your destination.

What help is available if my flight is cancelled?

Flights may also be affected by the latest bad weather.

If a flight is cancelled then you can take a refund, or an alternative route or flight to your destination. You must talk to the airline, rather than booking it yourself.

The airline should look after you, for example by providing meals if it is a long delay, but it does not have to pay the extra compensation that would be due had the delay been the airline's fault.

My home or business premises are flooded. What should I do?

When flood warnings are in place then safety is the key priority, so residents and business owners and their employees should only return to a property when it is safe to do so.

The Association of British Insurers (ABI) says most home buildings, contents and commercial business policies cover storm damage.

Commercial policies cover damage to premises and stock. Business interruption cover, which may be included or purchased separately as part of an insurance agreement, will cover additional trading costs.

Comprehensive motor insurance covers the cost of repairing or replacing vehicles damaged by storms.

Image source, Getty Images

Image source, Getty Images

Storm Bert caused extensive flooding in Wales

The ABI has a six-step recovery guide, external on what to do if your home or business is flooded:

Contact your insurer as soon as possible: It will advise on emergency accommodation or temporary alternative trading premises

Assess the damage: A loss adjuster will assess the claim

Cleaning and stripping out: Work should start within four weeks

Disinfecting and drying your home: This can take from a few weeks to several months

Repair and reconstruction: A builder appointed by your loss adjuster should begin after you get your drying certificate

Moving back in: This can take between a few weeks and a year or more, depending on the extent of the damage

Insurers can advise on making sure repairs are resilient and more resistant to future floods.

Anyone who may not have been affected this time, but may be in the future, should consider taking steps to ensure they are prepared, external.

Will a flood-risk home be impossible to insure?

A government and insurance industry scheme called Flood Re, external should ensure affordable insurance is available for homes at risk of flooding or which have been flooded before.

Buying insurance should not be any different to normal, but the extra risk is covered by the scheme - through a levy on insurers - rather than by individual companies. That should mean no areas become uninsurable. Various criteria, external apply.

By BBC (Business) | Created at 2025-01-24 09:56:08 | Updated at 2025-01-24 17:30:04

7 hours ago

By BBC (Business) | Created at 2025-01-24 09:56:08 | Updated at 2025-01-24 17:30:04

7 hours ago