Ford

Ford

Ford has announced it will cut 800 jobs in the UK over the next three years.

The move is part of a major restructuring programme, which will see 4,000 posts closed across Europe as a whole.

The company said it had to act because of difficult trading conditions, including intense competition and weak demand for electric vehicles.

However, the cuts will not affect its manufacturing sites in Dagenham and Halewood, or its logistics base in Southampton. Ford said it hoped to make the majority of job cuts through voluntary redundancy.

“Making this announcement isn’t something that anybody wants to do, and I appreciate it will have a very significant impact on our employees,” said Lisa Brankin, managing director of Ford of Britain and Ireland.

“It’s not the news anyone wants to hear at any time. So our aim is to try to deliver this through voluntary redundancy."

Ford has 5,300 employees in the UK.

The restructuring plan will remove 15% of its workforce. The majority of them are expected to be administrative or product development roles.

The company currently makes diesel engines for vans at its Dagenham factory in Essex.

It builds gearboxes in Halewood and is in the final stages of creating a major new facility for producing motors for electric vehicles on the site.

Both factories are being protected from the cuts, along with Ford’s transport operations division, which is based in Southampton.

However, six other sites across the UK could be affected, including a major research and development centre at Dunton in Essex, where it also has its UK headquarters, and a giant parts distribution centre in Daventry.

This is the second round of cuts to hit Ford’s operations in Britain in less than two years. In March 2023 it said 1,300 jobs were to go, a fifth of its workforce, most of them at the Dunton site.

ANDY RAIN/EPA-EFE/REX/Shutterstock

ANDY RAIN/EPA-EFE/REX/Shutterstock

The latest announcement comes at a time when car manufacturers across Europe are struggling.

Among the issues they face are high energy costs, weaker than expected demand for electric cars and growing competition from Chinese manufacturers.

Many of the continent’s biggest names, including Volkswagen, Mercedes Benz and BMW have seen their profits tumble this year.

Volkswagen is even contemplating the closure of factories in Germany, a step that would be unprecedented.

“The automotive industry is going through a period of massive disruption at the moment,” explained Ms Brankin.

“We’ve got unprecedented competition, regulation and lots of economic headwinds”

Those pressures are hitting Ford at a difficult time. The carmaker is attempting to move away from its past as a mass-manufacturer of cheap "runabouts", and position itself as more upmarket brand, focused on electric cars. Last year, it stopped making the Fiesta after nearly five decades.

In addition to the cuts in the UK, Ford will be shedding 2,900 jobs in Germany and another 300 in the rest of Europe.

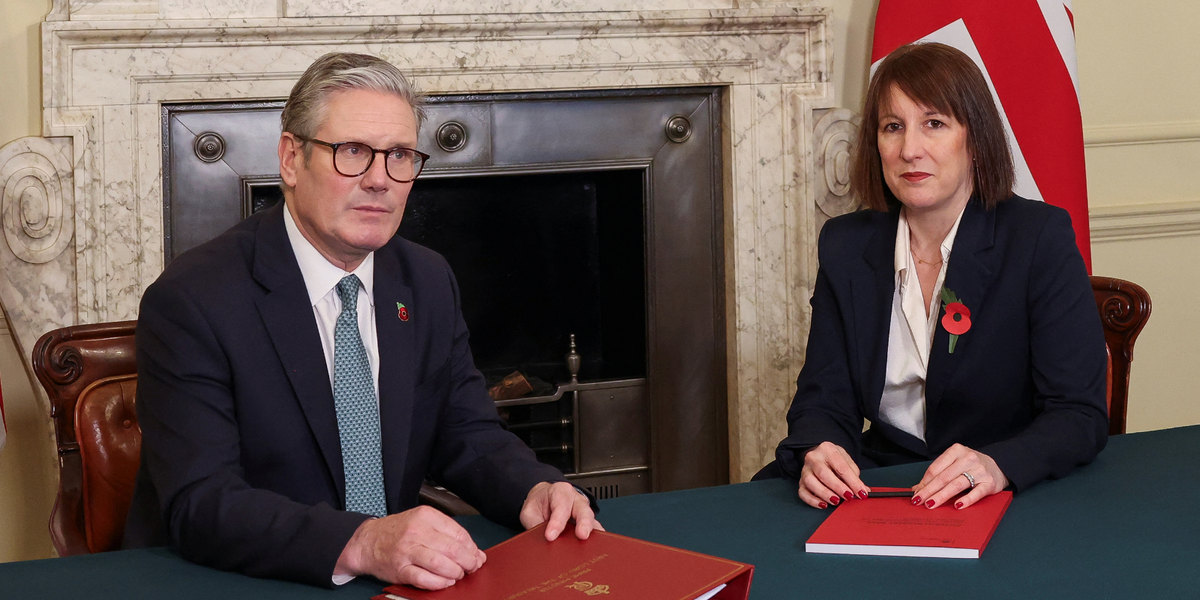

Meanwhile in Britain, the government is coming under intense pressure from the car industry over rules designed to force them to build more electric vehicles. The issue is due to be discussed at a meeting between industry and ministers on Wednesday afternoon.

Under the so-called Zero Emission Vehicle (ZEV) Mandate, which came into force this year, at least 22% of cars sold must be classed as zero emission. If manufacturers fail to hit their quotas, they could face fines of up to £15,000 per car.

A number of carmakers are already struggling to meet their targets, although there are flexible mechanisms built into the rules which should allow them to avoid fines for the moment.

But the quota is due to rise to 28% next year, and to 33% in 2026 – being ramped up each year after that to hit 80% by 2030.

Manufacturers insist this is happening too fast. They claim demand for electric cars simply isn’t high enough yet, forcing them to offer unsustainable discounts in an effort to meet their targets.

Some are calling for the government to water down the quotas, in order to give them more time.

Others say it needs to offer greater taxpayer-funded incentives for electric cars, and to do more to reassure car buyers that enough charging infrastructure will be built.

But according to Vicky Read, chief executive of charging firm Charge UK a weakening of the mandate would be the wrong move.

"The government must hold its nerve and use the meeting to signal support for a policy that is evidently working," she said.

By BBC (Business) | Created at 2024-11-20 13:33:07 | Updated at 2024-11-20 15:38:04

2 hours ago

By BBC (Business) | Created at 2024-11-20 13:33:07 | Updated at 2024-11-20 15:38:04

2 hours ago