(Analysis) Delta Air Lines CEO Ed Bastian warned investors Monday that economic concerns already affect domestic travel. “We saw firms begin to retreat. Corporate spending started to stagnate,” Bastian said, adding that “consumers in a discretionary business don’t like uncertainty.”

President Trump imposed sweeping 25% tariffs on steel and aluminum imports Wednesday, expanding his aggressive trade agenda that already targets China, Mexico, and Canada. Business leaders across industries express growing anxiety about these measures.

Ford CEO Jim Farley described the tariffs as creating “costs and chaos” while retailers warn of immediate price pressures. Market reactions appeared swift and severe, with nearly $5 trillion in market capitalization erased from February’s S&P 500 peak.

However, market declines likely reflect broader concerns about valuations. Warren Buffett‘s Berkshire Hathaway has systematically built a $325 billion cash reserve over nine consecutive quarters, suggesting the legendary investor anticipated corrections based on fundamental overvaluation.

The S&P 500’s price-to-earnings ratio reached 27.31 in March—significantly above its historical median of 17.9. “Buffett began hoarding cash well before any tariff announcements,” notes economist Michael Stevens. “This correction was likely coming regardless of trade policy.”

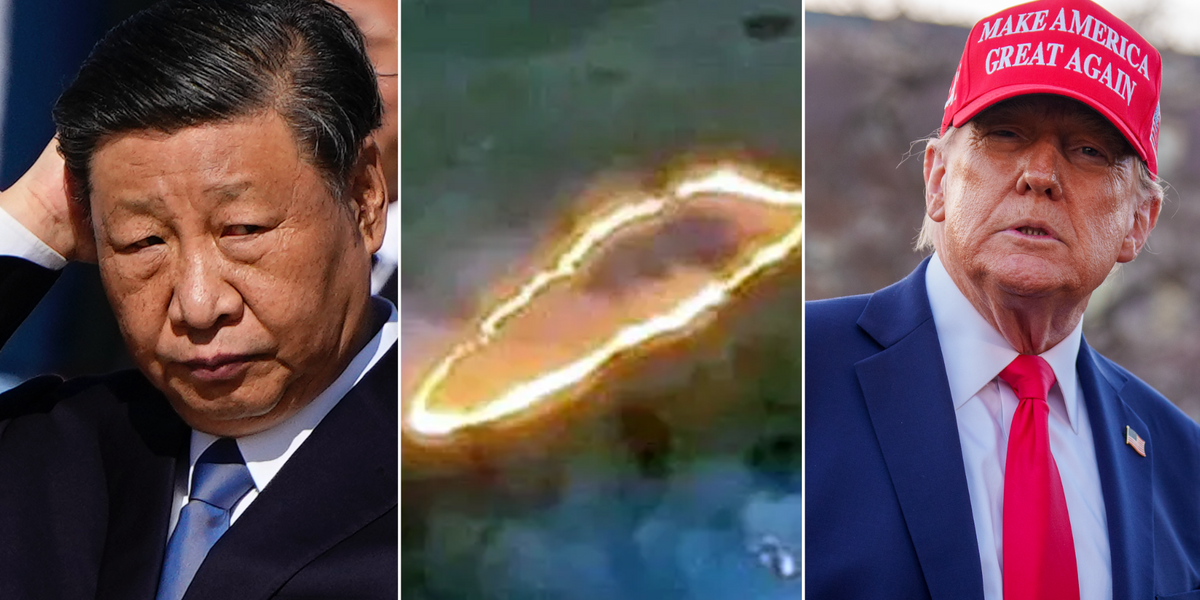

From Wall Street to Main Street: The Real Impact of Trump’s Trade Revolution. (Photo Internet reproduction)

From Wall Street to Main Street: The Real Impact of Trump’s Trade Revolution. (Photo Internet reproduction)Trump frames these tariffs as strategic investments in American industry. “The higher I put it, the more likely they’re going to build here,” he told business leaders Tuesday.

The administration projects the measures will generate approximately $300 billion in federal revenue while incentivizing manufacturing relocation to American soil.

Trump’s Tariff Policy and Its Economic Impact

Evidence from Trump’s first term showed targeted steel tariffs decreased imports while raising domestic production.

Robert Simon, CEO of JSW Steel USA, praised the current approach as “a project that will flood the U.S. with jobs as trading partners move their industries to U.S. soil.”

While economists project potential household costs of $1,200-$2,000 annually from tariffs, these might be offset by Trump‘s energy policies.

Buffett’s Cash Hoard and Beyond: A Warning for World Markets

The administration’s push to expand domestic energy production aims to reduce costs for manufacturers and consumers alike. Natural gas prices particularly stand to benefit from reduced regulatory burdens.

Manufacturing companies face complex tradeoffs. Higher input costs could hurt margins, but protection from foreign competition may allow domestic expansion.

The Steel Manufacturers Association and Aluminum Association broadly support these protective measures as necessary for maintaining industrial capacity.

Trump acknowledges potential “short-term pain” but maintains these policies will strengthen America’s economic position long-term.

His administration envisions transforming toward a “production-based economy” that prioritizes domestic manufacturing over imported goods.

The effective U.S. tariff rate now stands at nearly 14%, its highest level since 1939. As global trading partners announce retaliatory measures, businesses and consumers alike prepare for a fundamentally reshaped economic landscape.

By The Rio Times | Created at 2025-03-12 12:26:26 | Updated at 2025-03-12 19:33:49

7 hours ago

By The Rio Times | Created at 2025-03-12 12:26:26 | Updated at 2025-03-12 19:33:49

7 hours ago