Mapped: The Average Credit Card Debt in Every U.S. State

Visualcapitalist ^ | November 28, 2024 | Pallavi Rao

Posted on 11/28/2024 3:47:50 PM PST by ChicagoConservative27

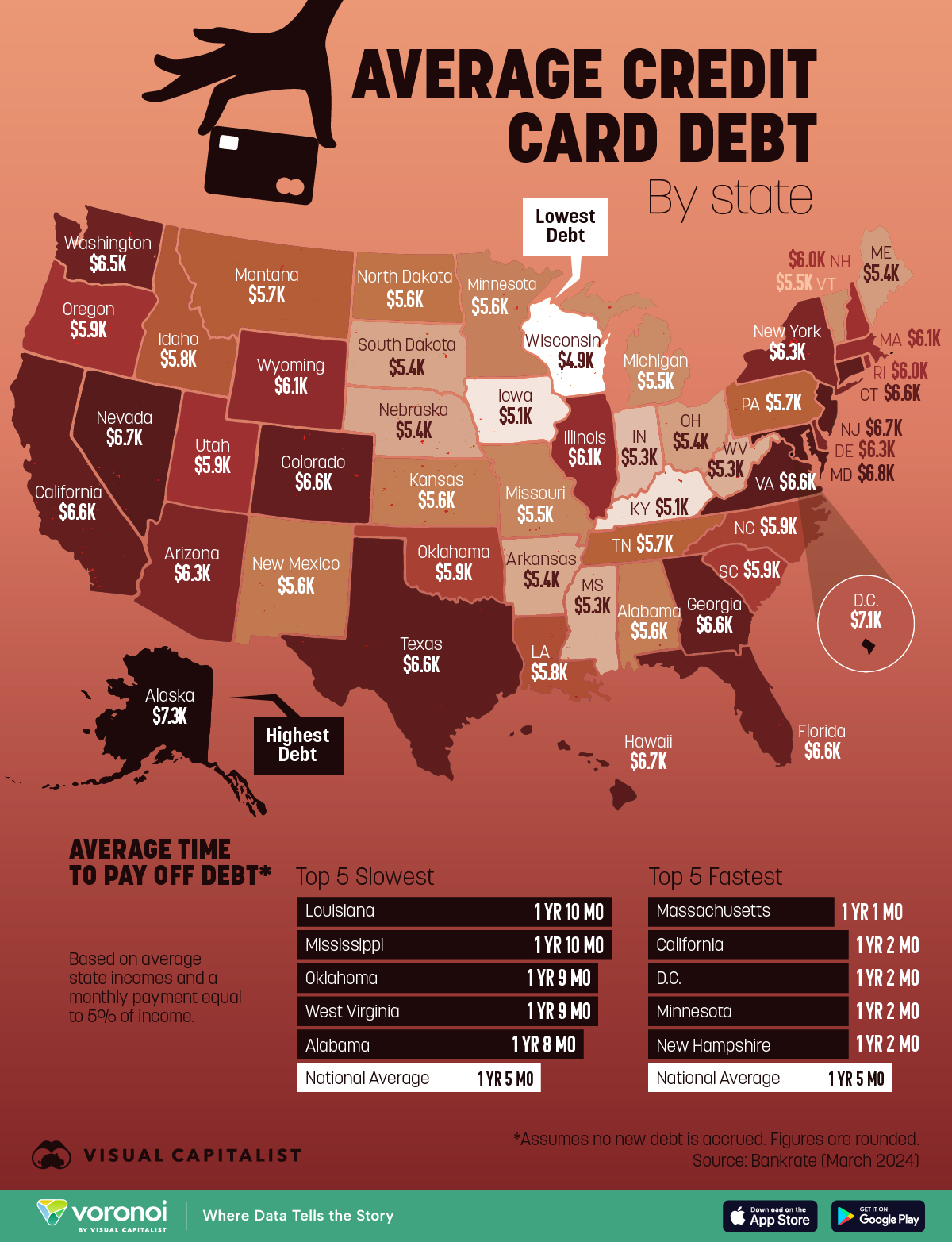

This map visualizes the average credit card debt held by households in each U.S. state and ranks the states where residents pay off the debt the fastest and slowest.

Data is sourced from Bankrate (2024) who also used average monthly household income to calculate how long it takes to pay off balances.

Households in Alaska and Washington D.C. are carrying more than $7,000 in credit card debt, the highest across the country. However, with average annual household incomes of $109,000 and $149,000, residents in both states can pay off their debt in about 15–20 months.

In fact, glancing through the numbers below reveals a pattern.

(Excerpt) Read more at visualcapitalist.com ...

TOPICS: Business/Economy; Education; Reference; Society

KEYWORDS: average; creditcard; debt; state

Click here: to donate by Credit Card

Or here: to donate by PayPal

Or by mail to: Free Republic, LLC - PO Box 9771 - Fresno, CA 93794

Thank you very much and God bless you.

Wow just wow

To: ChicagoConservative27

My Credit Card debt: $0.00 I grew up despising debt, and I still do to this day.

2 posted on 11/28/2024 3:51:18 PM PST by EvilCapitalist (Pets are no substitute for children)

To: ChicagoConservative27

3 posted on 11/28/2024 3:53:53 PM PST by Libloather (Why do climate change hoax deniers live in mansions on the beach?)

To: ChicagoConservative27

6k to 7k is about our average. We have on average 2 months of charges. We charge everything we can to get points that reduce our costs by at least 2%. We scheduled each card to be paid off monthly.

4 posted on 11/28/2024 3:54:12 PM PST by Raycpa

To: ChicagoConservative27

The averages are not that far apart between the states.

5 posted on 11/28/2024 3:54:29 PM PST by Wuli

To: EvilCapitalist

My credit card debt is also 0. Have one business card that I pay off every month. I think many Freepers are also in the same position.

6 posted on 11/28/2024 3:55:02 PM PST by pnut22

To: EvilCapitalist

My credit card debt stays at $0.00, too.

I pay it off every month.

7 posted on 11/28/2024 3:55:46 PM PST by gitmo (If your theology doesn’t become your biography, what good is it?)

To: ChicagoConservative27

That is $1,200 in interest per year paid on top of the ‘cut’ that the card issuer gets for every transaction or if you pay hundreds just to have the credit card.

8 posted on 11/28/2024 3:56:05 PM PST by jdt1138 (Where ever you go, there you are.)

To: ChicagoConservative27

I fit right in the FL stats, but I have a good excuse. A years ago I had the house ductwork replaced, and I signed a finance agreement thinking it was a loan like a car loan. It turned out to be a credit card application, and the loan was a credit card purchase at a special rate. So now I have a credit card balance which I’m paying off double time so I can go back to zero balancing my cards every month.

9 posted on 11/28/2024 3:56:12 PM PST by chajin ("There is no other name under heaven given among people by which we must be saved." Acts 4:12)

To: ChicagoConservative27

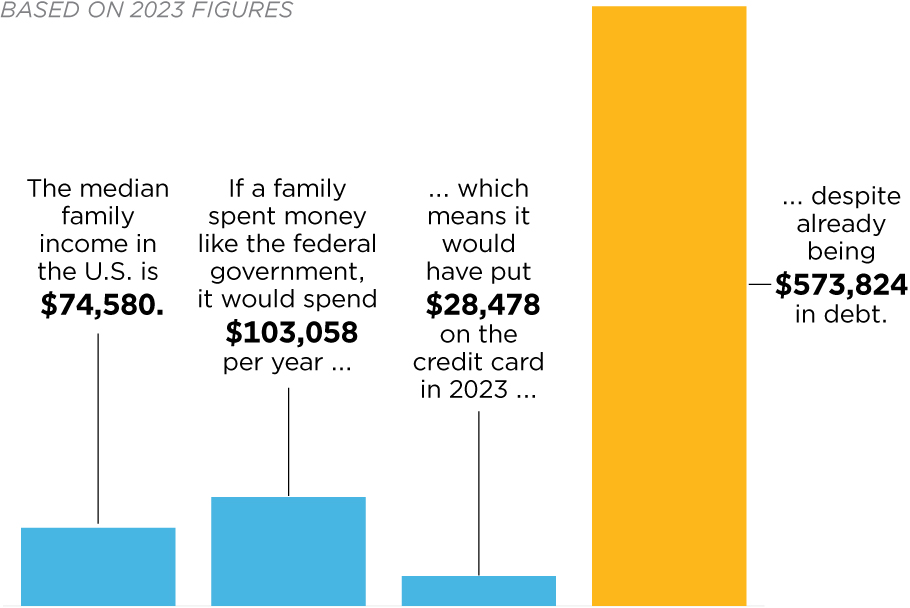

Per AI

- Per Household Debt: The national debt equates to $272,173 for every household in the U.S.

- Debt-to-Income Ratio: If a median-income American family spent money like the U.S. government, it would have spent all of its earnings and then put over $28,000 on a credit card in 2023, while already being $573,000 in debt.

- Debt vs. Consumer Debt: The national debt is 77% more than the combined consumer debt of every household in the U.S.

10 posted on 11/28/2024 3:57:21 PM PST by Responsibility2nd (Climate Change is Real. Winter, Spring, Summer and Fall.)

To: ChicagoConservative27

I posted data in post 10 just to show how little the average family debt is in comparison to the US debt.

11 posted on 11/28/2024 3:59:17 PM PST by Responsibility2nd (Climate Change is Real. Winter, Spring, Summer and Fall.)

12 posted on 11/28/2024 4:01:43 PM PST by Chode (there is no fall back position, there's no rally point, there is no LZ... we're on our own. #FJB)

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

By Free Republic | Created at 2024-11-29 00:02:33 | Updated at 2024-11-29 02:31:27

2 hours ago

By Free Republic | Created at 2024-11-29 00:02:33 | Updated at 2024-11-29 02:31:27

2 hours ago

![AMERICA Prayer Vigil – 29 November 2024 [Prayer]](https://news.devevil.com/site/uploads/2024/Apr/14/news2.png)