Farmers and rural folk united yesterday in Westminster to protest the Government’s treatment of farmers, namely slapping them with 20 per cent death duties on assets over £1million.

The move has been fiercely criticised as fatal for asset-rich but cash-poor family farms who won’t be able to pay the tax from farm income, precipitating land and machinery sales making many farms unviable.

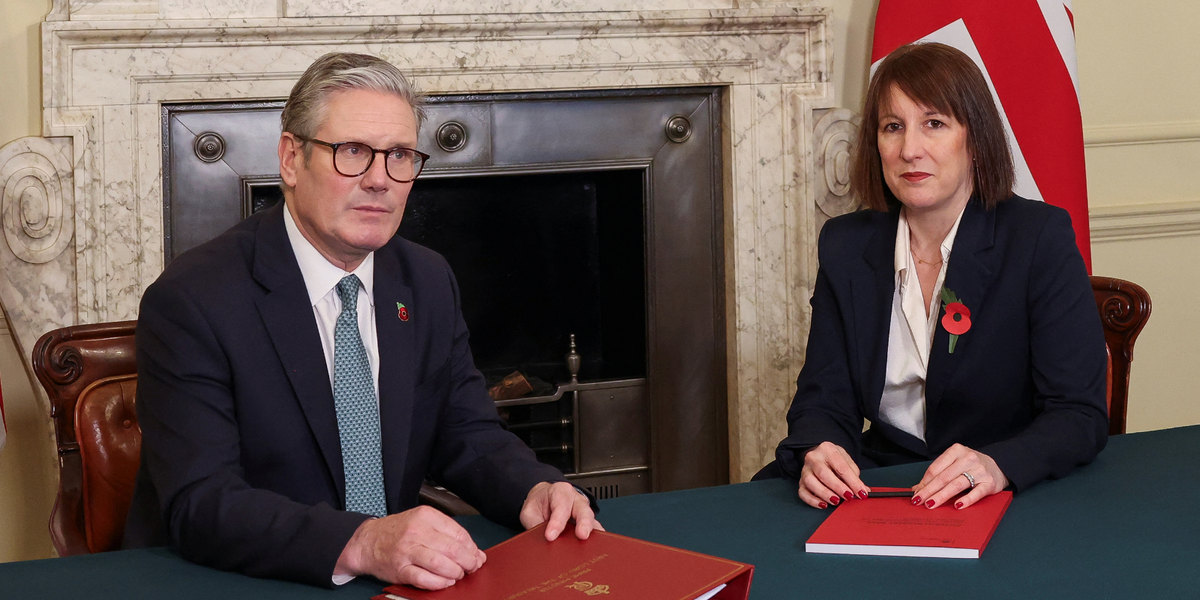

Chancellor Reeves and Defra Secretary Steve Reed argue only the richest farmers will pay and that ‘farmers need to pay for the NHS’ while they fill the £22billion black hole.

Much of the debate has centred on the £520 million figure the Treasury hopes to raise each year by 2030, a contested figure.

Critics have pointed out this number would fund the NHS for a little over one day. It is 50 times smaller than the amount raised via Reeves’ NIC hike.

Questions have been asked as to whether it is worth inflicting such anxiety on the farming community for such a small amount of money.

GB News reporter Will Hollis travelled down the A1 yesterday with a busload of farmers on their way to protest in Westminster.

He reported: “Spirits are really high because it's not often you get this many farmers together.

“But the reason that so many farmers are gathering is because they're heading to London to lobby MPs to protest against the inheritance tax, which was announced in the budget.”

Asked to sum up farming at the moment, Simon said: “It's difficult. It'svery difficult. We've gone through a rough period of time.

“But farmers here, I mean, there's many here on this bus who are seventh generation farmers. This isn't new to us.

“But with something like this [budget], it stops you wanting to invest and wanting to push forward. So there will be no development that we know prosperity, which this government has come in and saying they want to push us forward, want us to be producing more and producing more for the country.

“But this is going to do the opposite. It's going to make people want to shrink, want to risk less and invest less.”

Hollis then spoke to a father and son farming duo, asking the former what his future might look like under the new rules.

“Well, I mean, it's not just about inheritance tax. It's about all the taxes that are being implemented. [Fertiliser and pick-ups are also being subjected to new taxes].

“And, obviously if they give me an inheritance tax bill of 20% on our assets, there's going to be a large tax bill to pay. And the income coming in at the moment on the farm will not pay for that.”

One farmer called Charlotte took an interesting view on the motivation behind Labour’s tax raid.

Charlotte, who was supporting a Make America Great Again hat, said: “On a micro level, these individual farmers are all going to have their own issues.

“I'm thinking above all that on the macro level of what's going on, looking at the patterns and trends over the years in all sorts of businesses.

“I feel that this is a political weapon to initiate a globalist land grab. That's really it.

“The Bill Gates of the world that own so much land will ultimately end up owning your own land.”

Inheritance tax changes are set to come in in April 2026.

By GB News (World News) | Created at 2024-11-20 12:11:26 | Updated at 2024-11-20 14:32:34

2 hours ago

By GB News (World News) | Created at 2024-11-20 12:11:26 | Updated at 2024-11-20 14:32:34

2 hours ago